1.0 Introduction

Some business models ignore traditional business logic and seem destined to fail - but then, they defy expectations and thrive.

Basic-Fit is one of them.

How did a low-budget gym chain not only survive when the pandemic crushed the fitness industry but also accelerated to nearly 1,600 locations?

2.0 The Business Model

At first glance, running a gym might seem straightforward:

Rent space;

Fix it up;

Buy equipment;

Hire employees

Do marketing;

Sign up members and

Keep it up and running.

But here’s the problem: the economics are brutal. There are high upfront investments, and in return, you can expect potentially thin margins and uncertain membership churn that could destroy the business.

When summarized that way, it doesn’t seem appealing.

The steps mentioned above apply to low-budget gyms and exclusive high-end fitness clubs.

When a gym starts operating, it loses money on day 1.

It loses money in week 1.

It loses money in month 1.

Eventually, there will be (hopefully) enough members to break even.

From that point on, every new member contributes directly to the gym’s profitability.

3.0 The Disappearing Mid-Tier Gyms

Many industries have three tiers, and the same is true for this one:

Low budget - focus on affordability and volume

Mid-tier - A balance of price and amenities

Premium - Focus on delivering a high-end experience for those willing to pay

Low-budget gyms have been redefining what 'basic' means. They’ve gone from limited equipment and minimal service to modern equipment, 24/7 access, and digital fitness classes, all for a fraction of what mid-tier gyms used to charge.

What once made mid-tier gyms attractive is now available in low-budget gyms.

Meanwhile, the premium ones have doubled down on exclusivity and experience, offering everything from spa facilities and recovery lounges to high-end machines and personalized training. They’re rebranding as lifestyle hubs, offering luxury that budget gyms can’t (and don’t need to) compete with.

Caught between the two forces, mid-tier gyms have lost their purpose. They can’t compete with budget gyms on price or match premium clubs on experience.

4.0 Basic-Fit

Now, let me introduce you to Basic-Fit.

Their low-cost membership comes with a valuable app, group classes, and access to multiple locations.

4.1 Ignoring the business logic

One rule in business is not to open a second physical location close to your first one, as it will cannibalize sales.

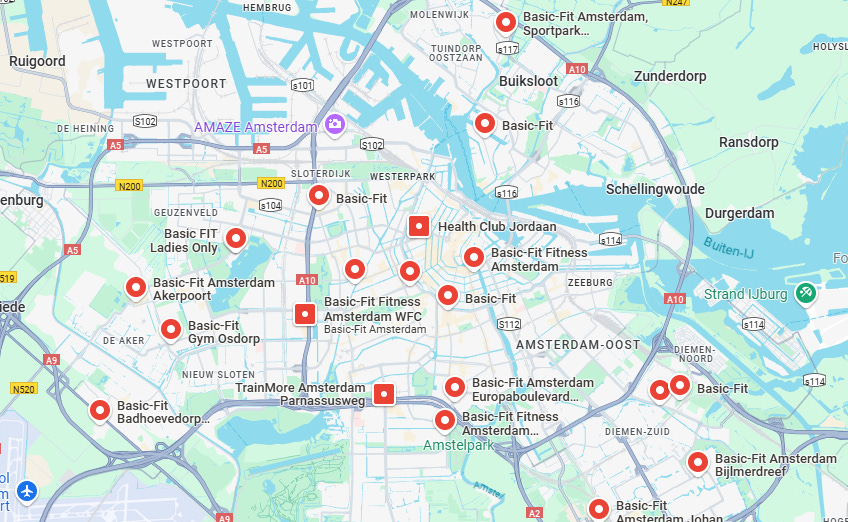

Yet Basic-Fit does exactly that. Below are maps of its locations in Amsterdam and Paris. This is called a cluster strategy.

Amsterdam:

Paris:

You’ll notice plenty of them, and you’re probably wondering—how does this make sense?

The answer is adding value through convenience. The same logic is behind Domino’s Pizza. Having more locations allows them to be closer to their customers.

Like Domino’s did with pizza delivery, Basic-Fit’s cluster strategy ensures that no customer is ever too far from a gym. The difference? Instead of delivering pizzas faster, Basic-Fit delivers fitness convenience—putting a gym within easy reach of its members wherever they are.

The convenience doesn’t end there. Those who work on the other side of the city or even in a different city can access another location without having to pay extra.

This is a value that individual gyms cannot offer.

But it doesn’t stop there.

4.2 Lower churn

With access to multiple locations and home workouts via the app—usable by other household members—Basic-Fit has a lower churn rate (24 months) compared to traditional gyms (12 months).

Lower churn is only part of the equation—there’s another key reason why individual gyms cannot compete.

4.3 Economies of Scale

The fewer employees needed per gym, the lower the overhead—and the more sustainable the business model.

The typical low-budget gym has six full-time employees (FTEs) who handle the front desk, operations, cleaning, sales, and customer service.

Basic-Fit has three full-time employees, and here’s how that’s possible:

Minimal Front Desk Staff - Many Basic-Fit locations operate with self-service kiosks and app-based check-ins, reducing the need for front desk employees;

Automated Customer Support - Many customer inquiries are handled through chatbots, FAQs, and digital channels, reducing staffing costs. In addition, when human response is needed, one employee can handle multiple locations;

Centralized Management - Instead of hiring individual sales teams per location, Basic-Fit runs centralized marketing campaigns and digital sales funnels, allowing new members to sign up online without needing in-person consultations;

Bulk Purchasing Power - Given its size, it has negotiation power on gym equipment, leases, and technology, lowering its per-unit cost compared to independent, individual gyms.

This is why Basic-Fit can offer lower prices while having high-quality equipment in place and in the end, have more profitable locations.

This cost advantage compounds over time, making it nearly impossible for smaller, independent gyms to survive against Basic-Fit’s scale.

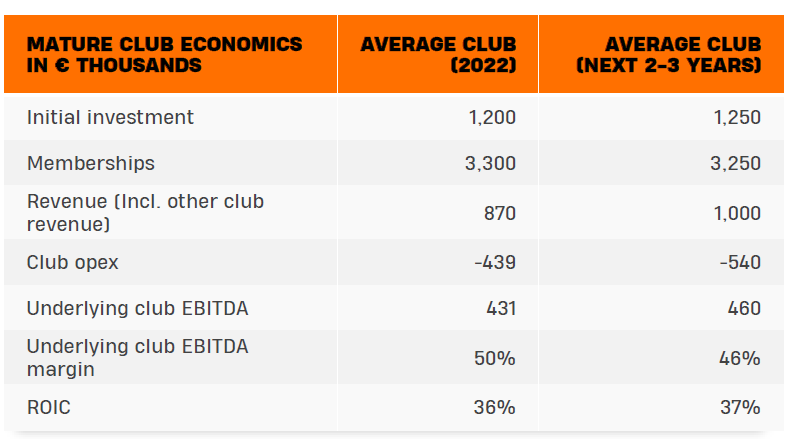

4.4 Unit Economics

Each new Basic-Fit location costs just over €1.2 million. It is breaking even after ~7 months, and once it is mature (2 years later), it delivers ~€460k in EBITDA.

These numbers explain why Basic-Fit can expand aggressively while still maintaining profitability. It’s a machine designed for rapid growth.

5.0 The history

Most of the time, I start the deep dive with the company's history. In this case, I thought it more appropriate to first provide insights into the industry.

At the center of this story is Rene Moos, a former tennis player who never planned to build a fitness empire.

He quit school to become a tennis player. When that didn’t work out, he transitioned into a tennis coach, founding his tennis school, which he expanded into a complex with 24 tennis courts and various fitness facilities.

Following a merger in 2004, HealthCity was founded, which later acquired Basic-Fit. Given its better reputation/proposition, all clubs were transformed into Basic-Fit clubs.

The expansion to France and Spain started in 2011.

In 2013, Rene decided to focus on Basic-Fit, which was spun off as a separate company.

In 2016, only 3 years later, it became a public company, and since 2017, it has been Europe’s largest and fastest-growing fitness chain.

In 2022, the first clubs in Germany were opened.

Today, Rene owns ~14% of the company.

6.0 What’s Next?

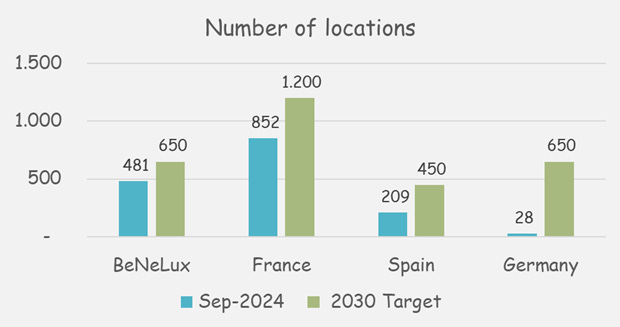

Below, you can find the population of each country & management’s target for the number of locations in 2030:

Germany - 84 million

France - 68 million

Spain - 48 million

BeNeLux - 30 million

This represents an increase of 85% over the next 6 years!

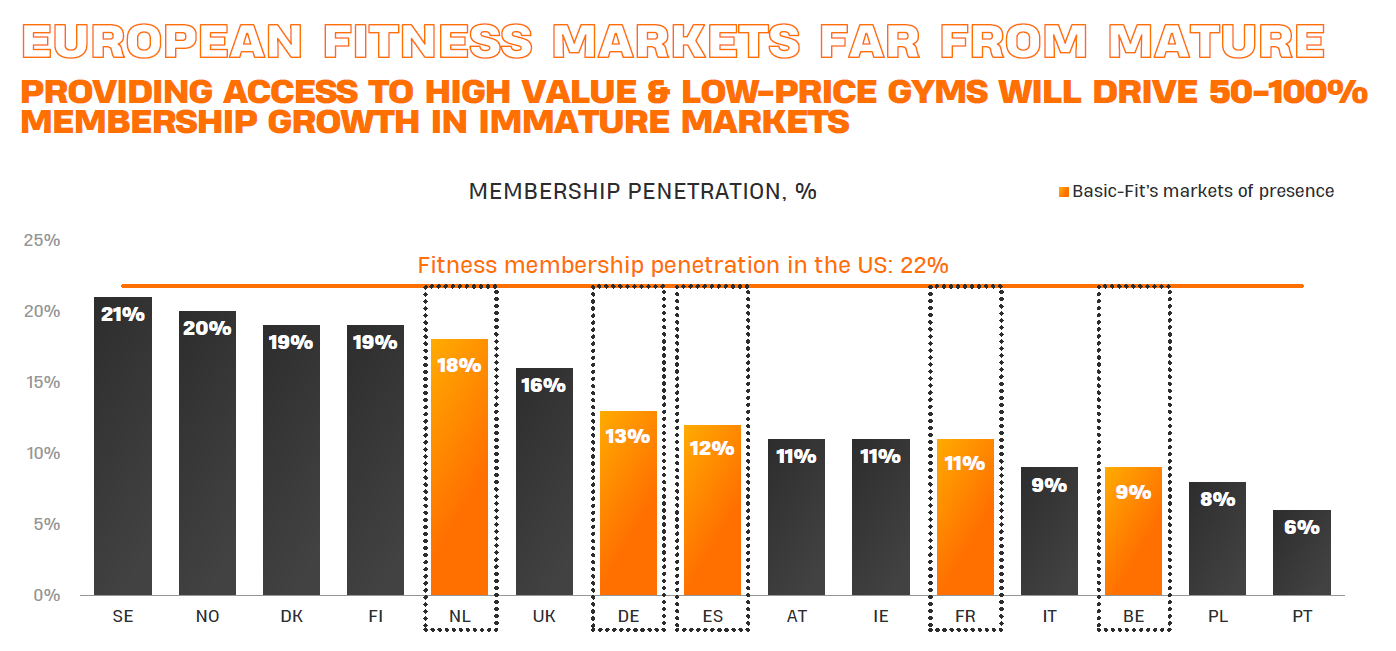

And the opportunity is there—at least, that’s what the data suggests.

Austria, Ireland, Italy, Poland, and Portugal might be next after Germany.

Only a few value-for-money fitness chains could go after this. The next three largest competitors combined have fewer locations than Basic-Fit.

6.1 Franchise

Until now, all of the Basic-Fit locations have been company-operated.

In June 2024, management announced that it is exploring franchise opportunities. Within the next 12 months, they will develop and share a clear vision of what’s next.

In the Q3-2024 trading update, the following was shared:

Basic-Fit expects to launch a franchise platform during 2025 in which it can leverage its scale advantages, technologies and knowledge. The franchise business will require limited capex and open up possibilities to expand to new countries. We are currently in discussion with strong potential franchisee partners with ample franchise experience in their respective countries. We expect that the first franchise clubs will be opened in the course of 2025, at which time we will communicate more details.

Yet, the public market wasn’t impressed.

The share price has fallen 33% over the last five years, partly due to the impact of the pandemic.

The traditional valuation metrics don’t make much sense, and here’s why:

7.0 Historical Financial Performance

Basic-Fit's operating margin is around 10%, but this doesn’t reflect its long-term potential, despite the flat trend in the chart below.

Almost all of that 10% disappears when factoring in the interest expense on its ~€2.7 billion debt, making the company appear barely profitable.

It is worth noting that two-thirds of the debt is related to leases, which doesn’t come as a surprise.

So, what are we missing? The maturity of the clubs.

The company considers a mature club one that is at least 24 months old at the start of the year.

Currently, ~60% of all clubs are mature, so ~40% of all clubs aren’t at their best (yet).

The average EBITDA per club is €305k, and the average for mature clubs is close to €400k. As the clubs mature, this will lead to an additional €150 million without opening any new locations.

Considering this impact, the operating margin will grow to ~20%.

7.1 CEO/CFO remuneration

The decline in 2020/2021 was due to the pandemic. Interestingly, the CEO and CFO’s remuneration dropped significantly during those years, not only because they missed their targets but also because they voluntarily decreased their salaries by 50% for a short time.

P.S. I think they still managed to survive with the reduced compensation.

8.0 Valuation

A traditional valuation metric is the P/E ratio. Currently, it stands close to 200.

However, if the company stops opening new locations and waits two years for them to mature, the P/E ratio will be closer to 10. And this excludes the impact of the franchise model or any price increases.

An interesting metric to follow is the free cash flow before new club expansion. It represents the EBITDA minus maintenance capex, cash interest, and cash taxes. I think this is a great metric for the cash flow of the existing assets.

Currently, this free cash flow metric is close to ~€130m per year. With its market cap being €1.5 billion, it represents a cash yield of 8.7%.

If no new clubs were opened, the maturation of existing locations would push this metric to at least €250m, translating to a cash yield of ~16%. This is what I believe is Basic Fit's potential long-term annual return.

Despite the clear long-term upside, the market remains skeptical. Why? Because rapid expansion comes with execution risk, and Basic-Fit’s €2.7 billion debt load raises concerns about its ability to weather economic downturns or rising interest rates.

Basic-Fit is playing a long game, and the market has its doubts. If the expansion strategy plays out and franchise partnerships accelerate growth, today’s valuation may look like a massive discount in hindsight.

I’d argue that Basic-Fit has a moat in the form of economies of scale. Although the barrier to entry is relatively low (~€1m), individual gyms have a low chance of survival.

If you found this deep dive valuable, consider sharing it with someone who would too. Your support helps grow The Finance Corner and brings more deep dives like this to your inbox.