1.0 Introduction

Crocs was founded in 2002, and we can all agree that its product design is unique. Critics claim it is ugly, while fans claim it is beautiful and personalizable.

Both of these groups are right. Beauty is in the eye of the beholder.

The key ingredient to the shoes, apart from the unique design, is their proprietary closed-cell resin (Croslite). This material allows the company to offer shoes with distinctive comfort properties, lightweight design, and resistance to odor.

In all fairness, the clogs (and sandals) aren’t the most exciting product line. So, how can the company innovate?

The answer is: personalization.

1.1 Personalization through color and partnerships

Offering a variety of colors is relatively straightforward, and in addition to that, Crocs collaborated with plenty of celebrities and high-fashion brands.

For reference, the above design is a collaboration with Post Malone. It sold out in under two hours. Utilizing the existing audience of celebrities turned out to be an excellent strategy for reaching new buyers.

Source: https://edition.cnn.com/style/article/post-malone-crocs-sold-out-trnd/index.html

Similarly, the Balenciaga ones sold out before they were even released.

Source: https://www.wmagazine.com/story/balenciaga-crocs-sold-out-pre-sale

These unique releases build hype and scarcity, turning Crocs into collector items, driving demand, especially among Gen Z.

The above one is a collaboration between MCM, Crocs, and Lindsay Lohan.

You get the point.

1.2 The Jibbitz

Apart from colors and collaborations, the second way to personalize is through Jibbitz. They were invented by a Colorado mother who started decorating her children’s Crocs. She noticed that the holes present an opportunity to attach a personal item.

The same year, she sold her company to Crocs for ~$10 million.

These tiny fashion accessories allow the users to personalize their clogs.

In addition, these are high-margin items.

2.0 The customers

The loyal customers love the products. There’s a subreddit with 38 thousand members filled with posts about their new Crocs, asking for community opinions, and the comments are really positive and supportive.

Here are the top posts over the last year, which give you an idea of who the average customer is:

To fully understand the company, there are two events to focus on: The pandemic and the HEYDUDE acquisition.

3.0 The pandemic

Everything was business as usual, and the revenue wasn’t fluctuating much.

Then, there was the pandemic that surprised everyone. But for Crocs, this was a positive surprise:

Q1-2020: Initially, the year started with the management removing the guidance. It wasn’t clear how this would impact Crocs.

Q2-2020: In this press release, the management guided for no surprises and that H2-2020 revenue will be flat compared to H1-2019.

Q3-2020: SURPRISE! The Q3-2020 revenue grew by 16%, and Q4-2020 will grow between 20% and 30%.

Q4-2020: SURPRISE! The Q4-2020 growth was 57%!

As many people worked from home, the demand for comfortable and affordable shoes significantly increased, and Crocs benefited.

The positive surprise led to a share price increase from $11 in March 2020 to $180 in November 2021.

Now, imagine you are in charge of a Crocs. The demand is sky-high, and you know it won’t last forever. Or will it? Who knows!

But one thing is for sure, it doesn’t feel safe.

The management opted to diversify the product line through an acquisition. An acquisition that the market hated.

4.0 HEYDUDE acquisition

In December 2021, Crocs announced the acquisition of HEYDUDE, a high-growth, highly profitable brand. The purchase price was $2.5 billion (~4x revenue), funded by:

$2.05 billion in cash and (through a long-term loan)

$450 million in Crocs shares.

Crocs already had clogs, sandals, boots, and shoes in their portfolio. With this acquisition, they added loafers/slip-ons and even more lightweight and comfortable footwear.

Here’s the CEO’s comments on the acquisition:

In the Q1-2022 presentation, the management revealed the goal to increase HEYDUDE’s revenue above $1 billion by 2024.

Fast forward to 2024, and the revenue was $824 million.

The market was right about hating this acquisition.

5.0 The rationalization

Andrew Rees has been the CEO since 2017 and has over 25 years of experience in the footwear and retail industry.

One decision I think is worth highlighting is the number of Crocs stores over time.

In 2017 and 2018, the company went through what they called rationalization. A significant number of stores were either closed or transferred to distributors or partners. The number of stores has decreased by almost 40% between 2015 and 2020, which is a bold move.

6.0 Historical Financial Data

The impact of the pandemic and the 2022 acquisition is visible. The company’s growth was temporarily accelerated; now, it’s back to low growth.

But the margins are incredible for a company in this industry.

However, there are two concerns:

The first is: Will the management make another poor acquisition and destroy more shareholders’ value?

Based on the last investor presentation, this is unlikely. They aim to continue investing in their brands, pay down the debt (primarily from the acquisition), and repurchase shares.

The company generates ~900m in free cash flow annually, which goes to debt repayment and share buybacks.

Note: The company’s market cap is $5.5 billion as I’m writing this.

The debt from the acquisition is being reduced.

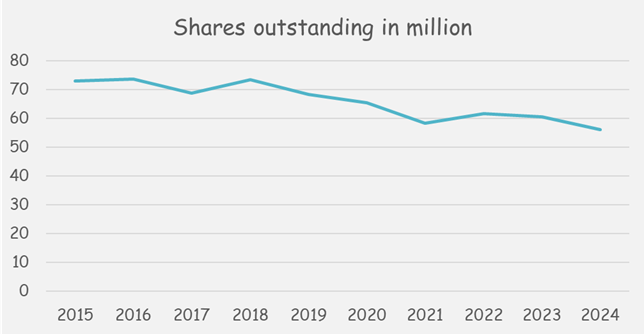

At the same time, Crocs has a track record of buying back shares:

In 2024 alone, the number of shares outstanding decreased by 7%.

The second concern is: Is this a fashion fad? The demand for their products went up due to the pandemic. There’s no guarantee that it will remain this high forever. The fashion industry moves quite fast, so this is definitely a valid concern.

7.0 Valuation

The last concern is crucial to valuing this company. It dictates the revenue growth/decline in the coming years. So, here are three cases to illustrate how much the valuation changes:

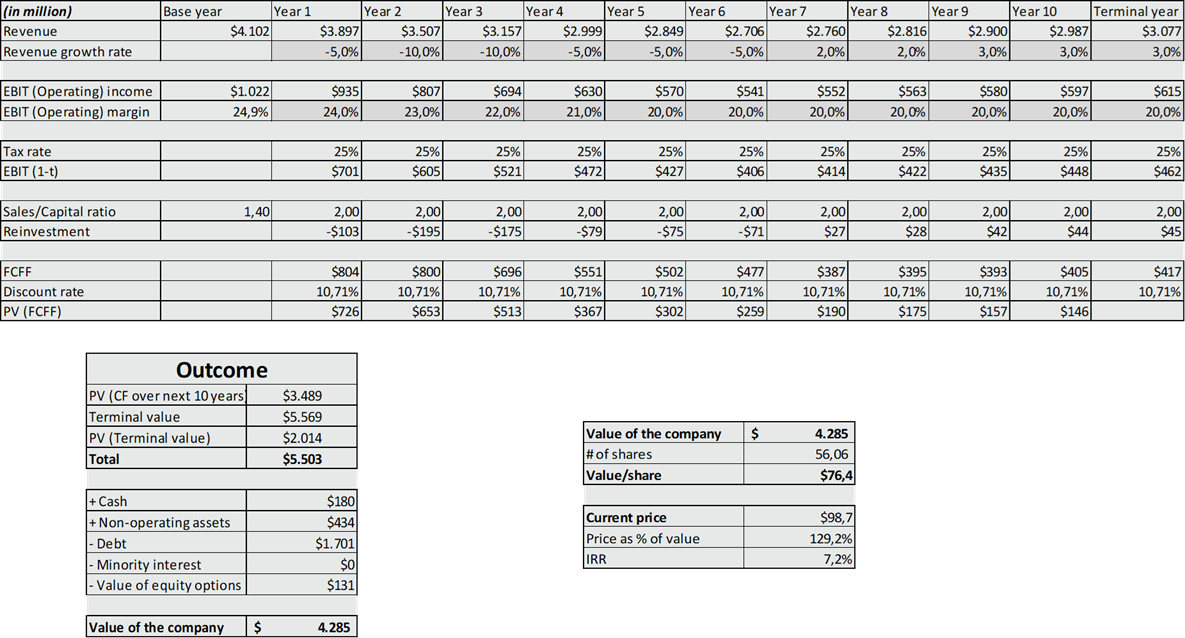

7.1 Bear Case

This case assumes that over the next decade:

Revenue will decrease from $4.1 billion to $3.1 billion; and

The operating margin will be ~20%.

Under these assumptions, the company's fair value is $4.3 billion ($76/share), significantly below the current market price.

7.2 Base Case

This case assumes that over the next decade:

Revenue will remain almost flat. Future price increases will offset the decline in product quantities sold; and

The operating margin will be 22%.

Under these assumptions, the company's fair value is $6.2 billion ($110/share), close to today’s market price.

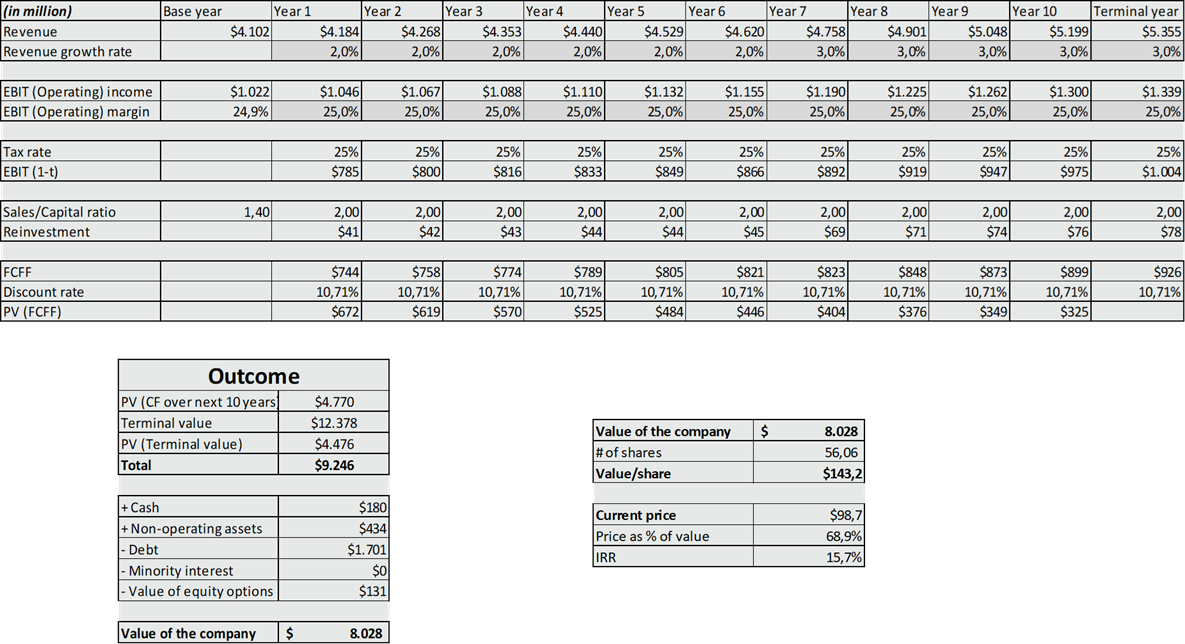

7.3 Bull Case

This case assumes that over the next decade:

Revenue will grow, and this is not a fashion fad.

The operating margin will remain ~25%.

Under these assumptions, the company's fair value is $8 billion ($143/share), significantly higher than the current market price.

In my opinion, anyone betting on Crocs is betting that:

There will be no stupid acquisitions, and

This is NOT a fashion fad.

8.0 Additional data

Here’s some additional data, for those who are interested:

8.1 The HEYDUDE acquisition, for which the company paid $2.5 billion, is generating ~20% of the total revenue.

8.2 Google Trends might be a useful tool to assess the demand for Crocs. Based on the last numbers, there were fewer searches in January 2025 compared to January 2024.

8.3 The growth is outside of the U.S.

Over the last two years, the revenue coming out of North America grew by less than 5%. The international revenue grew by 42%.

The revenue coming from North America declined in 2024 by almost 3%. Although it can be (again) argued that the peak has been reached, the split is very important:

Crocs’ revenue grew by 3%.

HEYDUDE revenue decreased by 13%.

8.4 Geographically diversified manufacturing

Vietnam accounts for 50% of the manufacturing of Crocs, and many countries are responsible for the rest, ranging from China, Indonesia, Bosnia, Mexico, Brazil, Argentina, and Romania. In today’s world with tariff rumors, I believe Crocs has an advantage through the flexibility to move operations as required.

8.5 The 2025 guidance

The company is guiding for ~2% revenue growth in 2025, although given the past, there can be a quick shift in demand, in both directions.

Currently, the expectations are that:

Crocs will grow by ~5%

HEYDUDE’s revenue will decrease by ~8%.

If you found this deep dive valuable, consider sharing it with someone who would too. Your support helps grow The Finance Corner and brings more deep dives like this to your inbox.

Nice summary. I think the bull case should include more growth coming from international expansion and turn around of HeyDude.

By the way, here is my deep dive on the stock:

https://www.moatmind.com/p/crocs-inc-stepping-boldly-into-the

Thanks for the write up. Just want to note that your bear, base, and bull cases do not account for buybacks. Continuing their current rate of buybacks ($1.3 billion authorized, 600k shares last quarter) over the decade has a dramatic effect on the share price.