1.0 Introduction

Dutch Bros BROS 0.00%↑ is capturing the attention of many with its impressive location growth.

What started as a small pushcart selling espresso drinks back in 1992, expanded to a chain with over 900 locations, posing the question:

Is it the next Starbucks?

2.0 The Secret To Its Success

Unlike the competitors, over 90% of the business is conducted through drive-thru, allowing it to operate using smaller (in size) shops.

50% of all the revenue comes from the sale of coffee;

25% from energy drinks (including its own proprietary Blue Rebel), and;

25% from other beverages (teas, lemonades, sodas, and smoothies).

Since 2008, the company has transitioned to an internal franchising model that required potential franchisees to have worked for the company for at least three years. Although this leads to fewer locations, it leads to better quality, which is best reflected in the number of closed locations.

Over the last 5 years, only one location was permanently closed (back in 2021). Today, roughly 1/3 of all the locations are franchises.

The management expects a more capital-efficient market entry process that will begin to deliver a stronger new shop return after 2025. The different types of shops give the company greater flexibility to match the market needs in a certain area.

3.0 The Potential Growth Drivers

There are 3 ways the company’s topline will grow over time:

3.1 Number of locations

The management’s long-term target is 4,000+ locations (vs. 912 locations as of June 2024). At the current pace of ~160/year, there are 2 decades of growth ahead.

This target represents roughly 10% of the total locations of Starbucks, which indicates:

The management intends the company to remain focused on certain key markets.

There are no plans for international expansion.

As the number of new locations has been growing every year, the target of 4,000 locations will likely take 10-15 years to reach (instead of 20).

In my opinion, Duch Bros isn’t the next Starbucks, for the following reasons:

Dutch Bros has a different business model leveraging drive-thrus.

The management has no intention (currently) to grow to the size of Starbucks.

Once it reaches maturity, the excess cash flow generated will likely be used to buy back shares and/or dividends.

3.2 New product introduction

In theory, introducing new products could lead to higher revenue per location. Based on the historical data, it is quite clear that this isn’t the case. The average revenue per location has been growing more or less in line with inflation. This means the sales coming from the new products introduced cannibalize the sales of the existing products.

3.3 Inflation

Although not in control of the company, inflation plays a role in its costs and will eventually be passed on to the consumers.

Therefore, in my estimate for the future revenue growth, I take into account the growth in the number of stores, and inflation. Feel free to disagree with it.

4.0 The Historical Financial Performance

Let’s take a look at the fun stuff.

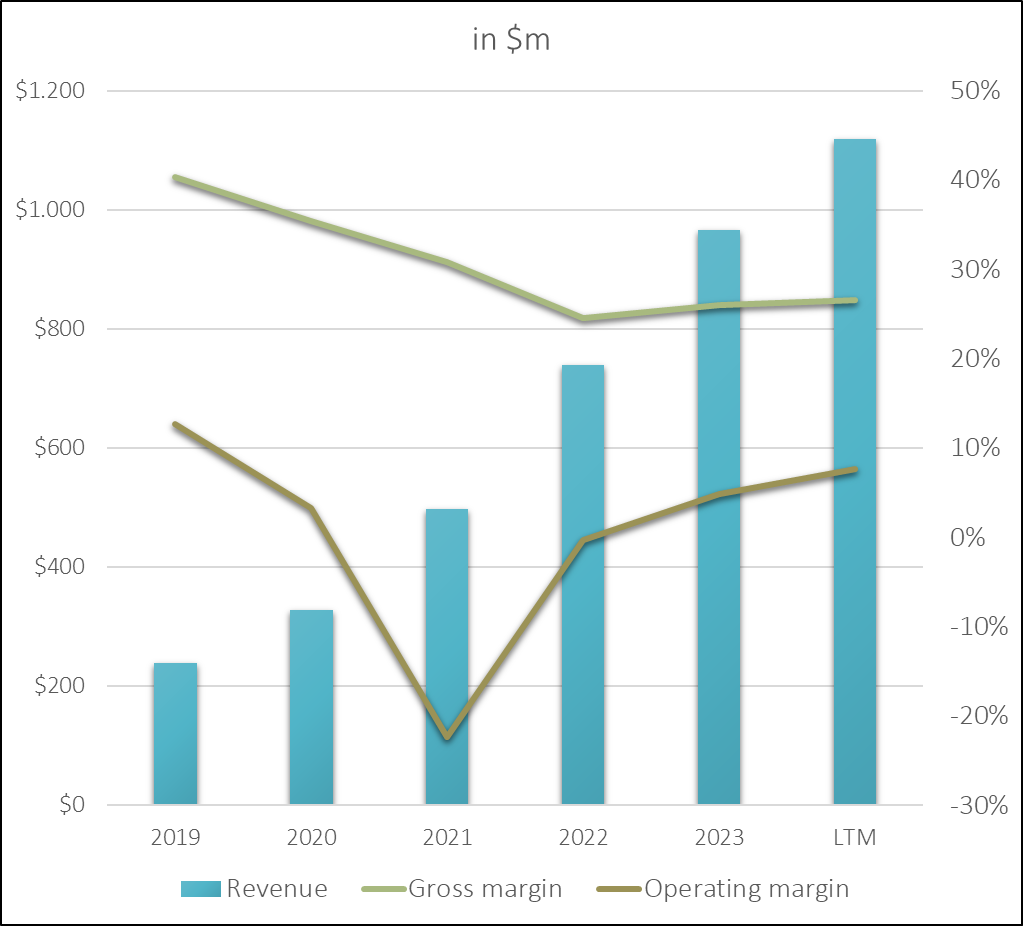

The revenue growth is expected.

However, the margins look, well, a bit odd.

The big drop in margins is mostly due to COVID-19 which has temporarily reduced demand. In addition, the management cited two more reasons:

Increase in rent; and

Increase in direct costs (related to beverage, food, and packaging)

Since 2022, the gross margin has been stable, yet, the operating margin has been improving. What is the reason behind that?

The answer is - Economies of scale.

SG&A has reduced from 28% to 19% of revenue.

The management is targeting 30% Adjusted EBITDA, which translates to roughly 18% operating margin. For comparison, this is slightly higher than the operating margin of Starbucks at ~16%.

5.0 Valuation

Based on my assumptions, the fair value of the company is close to $5 billion ($32/share), not that far from today’s price.

The revenue assumption has already been explained above.

As for the operating margin, I do think the management is overly optimistic, and the 18% operating margin is a stretch. For that reason, in my model, I’ve used 16% which is more in line with its mature competitors.

Here’s how the valuation (per share) changes if you have different assumptions than mine regarding the revenue growth & the operating margin:

As I’m writing this, the share price is ~$29, meaning for Dutch Bros to be undervalued, it needs to increase the number of locations to at least 3,000 in the next decade and increase its operating margin to at least 16%.

If the management delivers the guided margin expansion to 18%, the fair value today is over $35/share.

I hope you enjoyed this post, feel free to share your thoughts.