1.0 Introduction

eBay was originally called “AuctionWeb” when it launched in 1995. Its founder, Pierre Omidyar, created it as part of his website to experiment with online auctions. He listed his broken laser pointer for sale and sold it for $14.83. When he asked if the buyer understood the laser pointer was broken, the buyer responded that he was a collector and was still interested.

In 1997 the name was changed to eBay, and the rest is history.

The most expensive item ever sold on eBay is the Gigayacht, a 405-foot luxury yacht designed by Frank Mulder. It was purchased for $168 million by the Russian billionaire Roman Abramovich.

The auctions for a lunch with Warren Buffett also took place on eBay, with the 2022 auction being won by a bid of $19 million.

If you want to equip yourself with some fun facts, this list of unusual eBay listings might help.

2.0 Competition

eBay has been primarily known as the auction go-to-place, as well as the place to go for 2nd hand items. Although there is an overlap with its competitors, there is no doubt that it dominates the 2nd hand market, especially for trading cards and collectibles and it can be labeled as the market leader in Recommerce and auctions.

Its competition comes in different forms:

Amazon & Walmart Marketplace - Global eCommerce platforms focused on new products sold by businesses and third-party sellers.

Facebook Marketplace & Craigslist - Local Recommerce platforms enabling individuals to buy/sell used items within their communities.

Etsy - Global eCommerce with a focus on handmade and unique products, though it includes some Recommerce elements for vintage goods.

eBay supports eCommerce, but that is a more crowded market, where Amazon is king.

3.0 Its business model

eBay’s revenue comes in many forms:

Final value fees

Listing fees

Feature fees

Store subscription fees

Sale of advertisements

Revenue sharing arrangements

Shipping fees, etc.

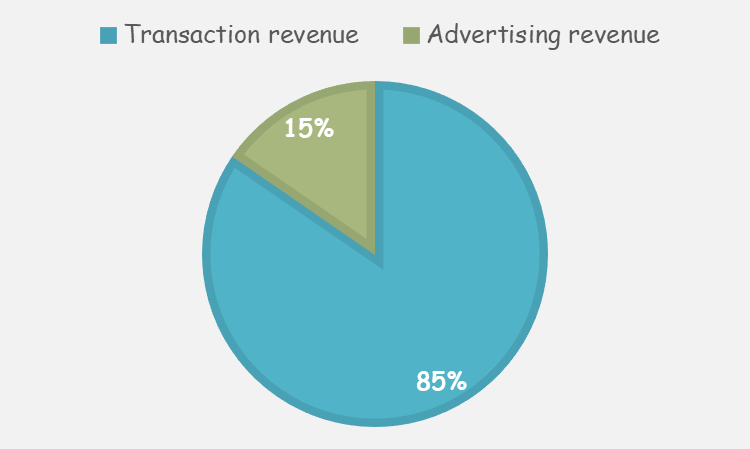

Ultimately, they can be grouped into 2 buckets.

3.1 The key metrics that do not add up

In companies of this kind, two important metrics are:

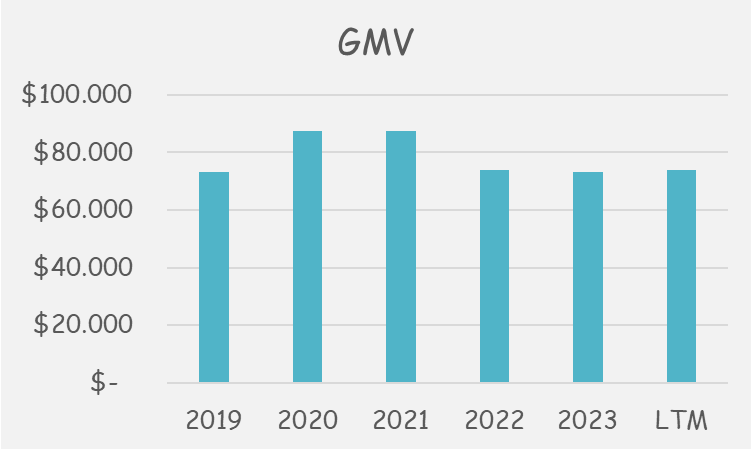

The Gross Merchandise Value, also known as “GMV”, represents the value of all products sold through the website.

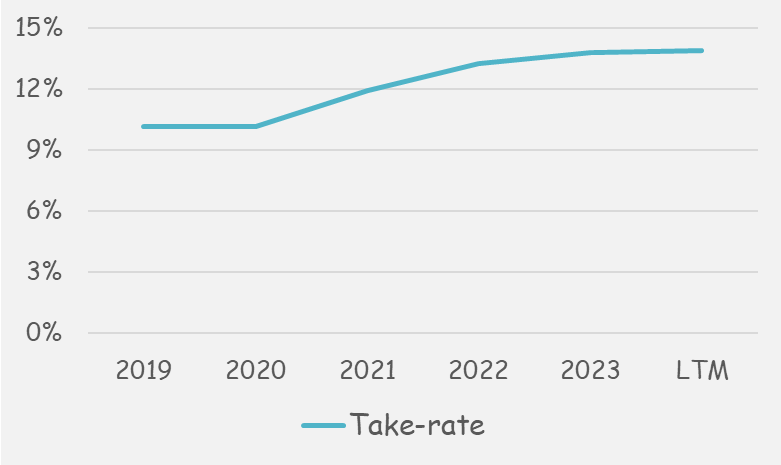

The take-rate represents their share of the GMV.

Let’s have a look at both of them.

The GMV temporarily grew in 2020 and 2021, driven by the pandemic. However, since then, it declined to the pre-pandemic levels. The conclusion is - eBay operates in a mature market with limited room to grow.

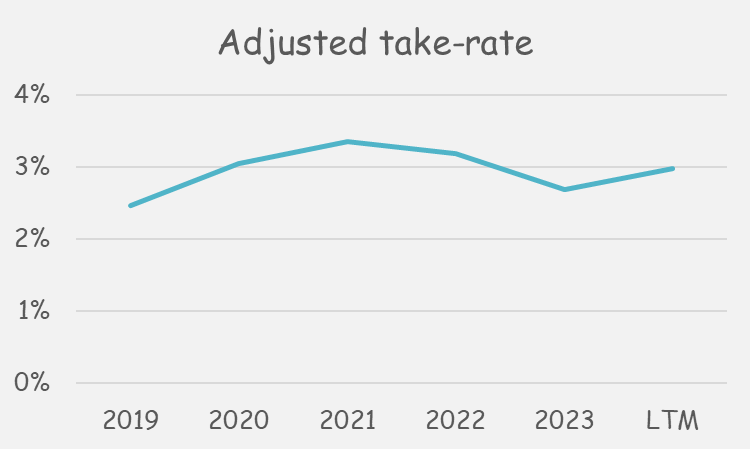

Now, if we take a look at the take rate over time, it seems impressive.

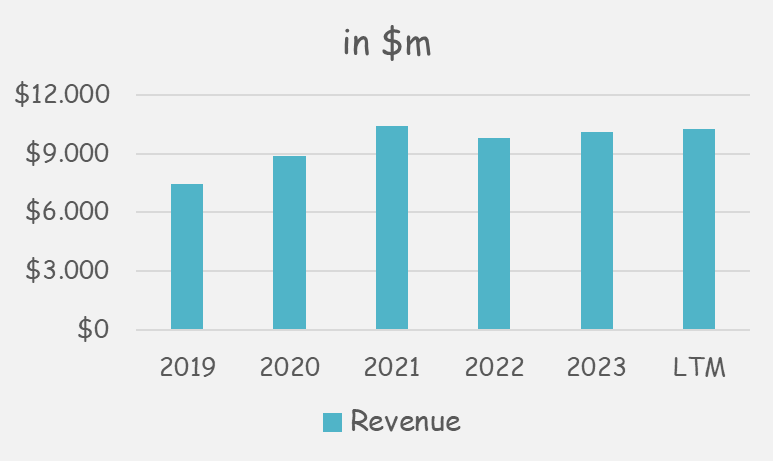

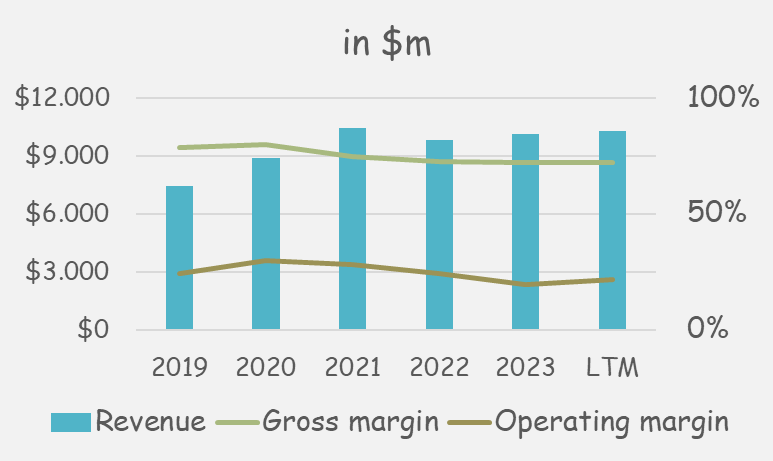

If you only see the two charts above, you’d expect that their revenue has grown.

However, that isn’t the case.

The revenue did grow during the pandemic, but it has been flat since 2021. If the GMV is flat, and their take-rate is increasing, their revenue should be growing. So, why is the math not adding up?

It is because eBay changed the definition of how they calculate take-rate.

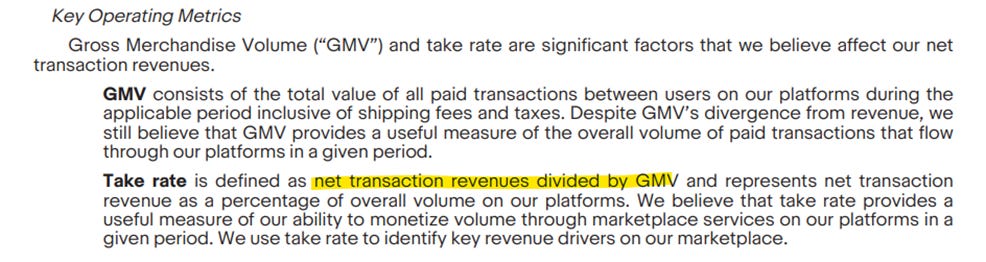

Here’s the definition in 2021:

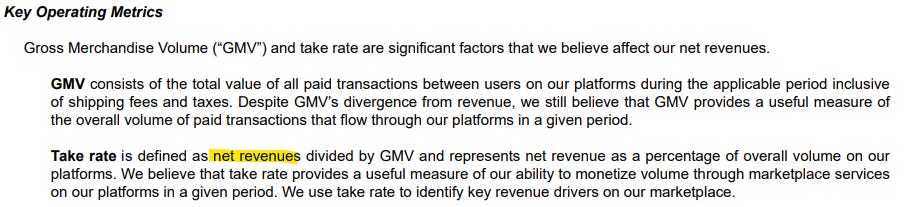

Here’s the definition as of 2022:

The difference between the two definitions is primarily the advertising revenue that hasn’t been included in the take-rate calculation before 2022.

Given that the definition changed, I opted for an alternative take-rate measure, which is the operating profit divided by the GMV. This is not a generally accepted definition, but it is one that I find most useful.

It would show the % of the GMV that is kept by eBay after covering all of the operating expenses.

This chart paints a different picture. The operating profit of eBay is relatively stable at around 3% of the GMV.

4.0 Historical Financial Performance

Although its revenue is flat, eBay is a cash-generating machine, bringing ~$2 billion in free cash flow per year (~1.4 billion if SBC is subtracted).

The share price of the company reflected the sentiment change around the pandemic, pushing the price up.

However, once the new growth expectations (of ~0%) were on the table, the share price went back almost to its pre-pandemic level.

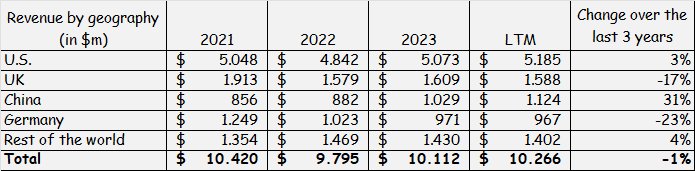

Behind the scenes, there’s something else worth noting. Not only has the revenue not been growing, but the composition has changed.

UK and Germany are contributing significantly less, and this decline is being compensated by growth primarily coming from China. Given that China comes with its additional risks (and competition), it can be argued that the revenue today is of lower quality than the revenue back in 2021.

This could indicate that the penetration rate in the U.S. and Western Europe is at its peak and the average long-term growth that can be expected is around the 3% historical inflation rate.

5.0 Capital allocation

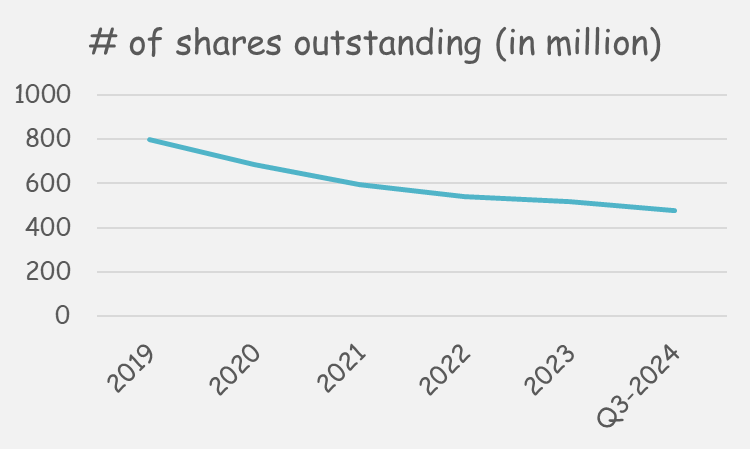

A huge focus of the management has been returning cash to the shareholders.

Since 2019, the company returned almost $28 billion ($25b via buybacks and $3b via dividends). A lot of this came from the company’s free cash flow, but part of it came from divestitures:

Sold 80% of eBay Korea to eMart.

Reduced ownership in Aurelia (the privatized Adevinta entity).

This led to a reduction of the number of shares outstanding by 40%. This is also a very impressive number if it is presented in isolation. However, half of the repurchases were done in 2020 and 2021, when the share price was quite elevated. In hindsight, that might not have been the best decision.

One notable long-term investment of theirs is Adyen, where they own 404k shares due to the warrants based on processing volume criteria. Given Adyen’s share price, these are worth around half a billion dollars.

6.0 Valuation

This is the time to put all the pieces of the puzzle together.

The key question to answer is - Given what is known today, how much is the company worth?

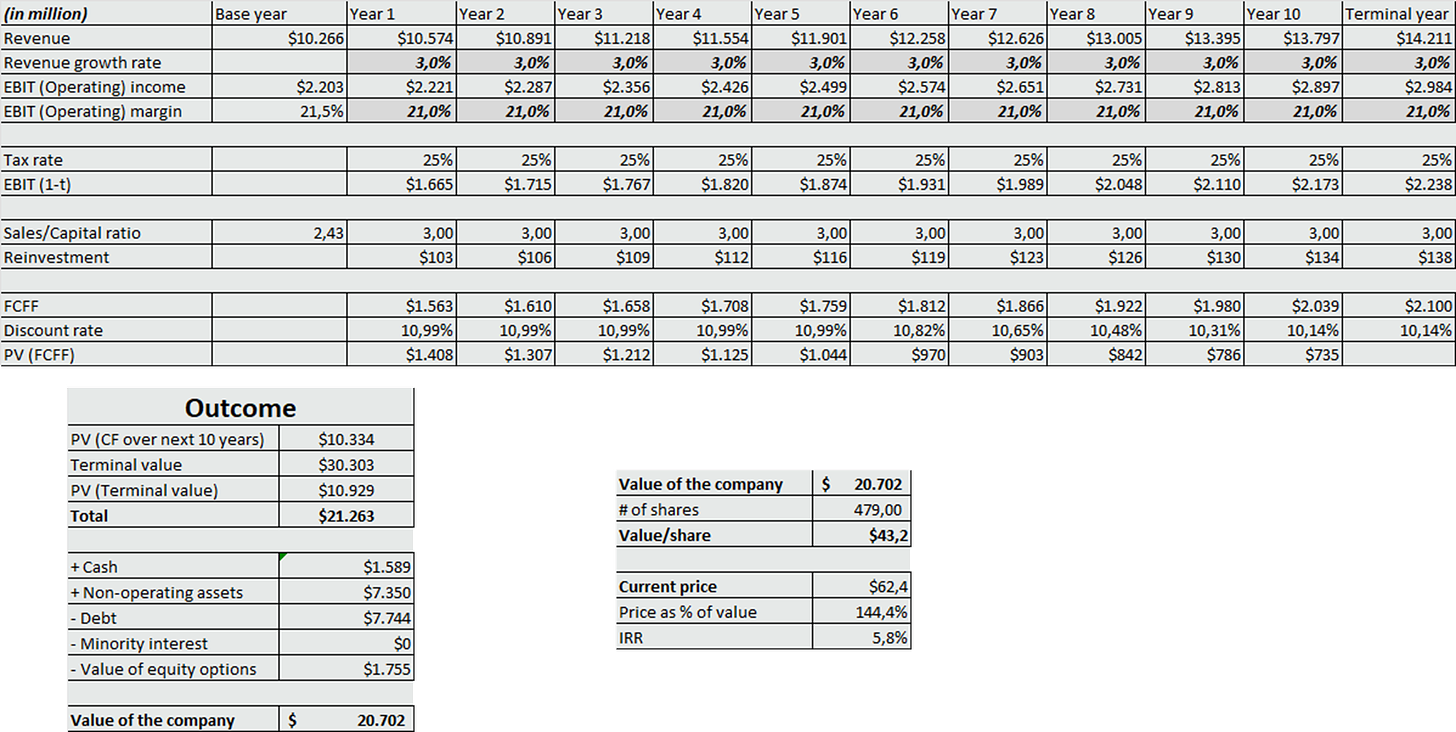

Based on everything mentioned above, my best estimate for revenue growth is in line with inflation, as this is a mature market with a high penetration rate in the developed countries.

Similarly, I do not see any levers that the company can pull to significantly increase its profitability. For that reason, I keep its operating margin at 21%.

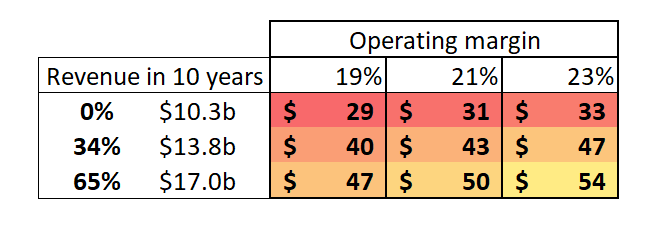

Based on my assumptions, the fair value of the company is $20.7b ($43/share), significantly below today’s share price of $62.

Here’s how the valuation (per share) changes if you have different assumptions than mine regarding the revenue growth & the operating margin:

If the DCF model is reversed, for eBay to be fairly valued today, it needs to double in size over the next decade (average annual revenue growth of 7%) and increase its operating margin to 23%. Although this isn’t impossible, there’s no evidence that eBay’s growth will re-accelerate.

I hope you enjoyed this post, feel free to share your thoughts.