1.0 Introduction

Enphase was founded in 2006, and it aims to become a one-stop shop for solar installers offering microinverters, energy storage, EV charging, and digital services for installers and homeowners.

It is widely regarded as the world leader in the microinverter market.

Wait, what is a microinverter?

It is the brain of a solar system. Its purpose is to convert direct current produced by solar panels into alternating current that households can use (or return to the grid) and optimize energy production.

What makes this better than the traditional string inverters?

Traditional string inverters serve multiple solar panels. A good comparison would be to Christmas lights. If one of them stops working (or generates less energy), the ones that follow. So, if there’s a shadow on one solar panel, it affects the performance of all the others.

On the other hand, a microinverter is attached to each panel, allowing it to function independently. That means the direct to alternating current is converted at each panel. Of course, this is much better for energy generation and optimization, but it comes with higher initial costs.

In addition, as they’re innovating in this area, the company has proprietary networking technology that collects performance data. Using cloud-based energy management, it offers the Enphase Enlighten platform, which provides analytics and ensures maximum production.

2.0 The journey of a company

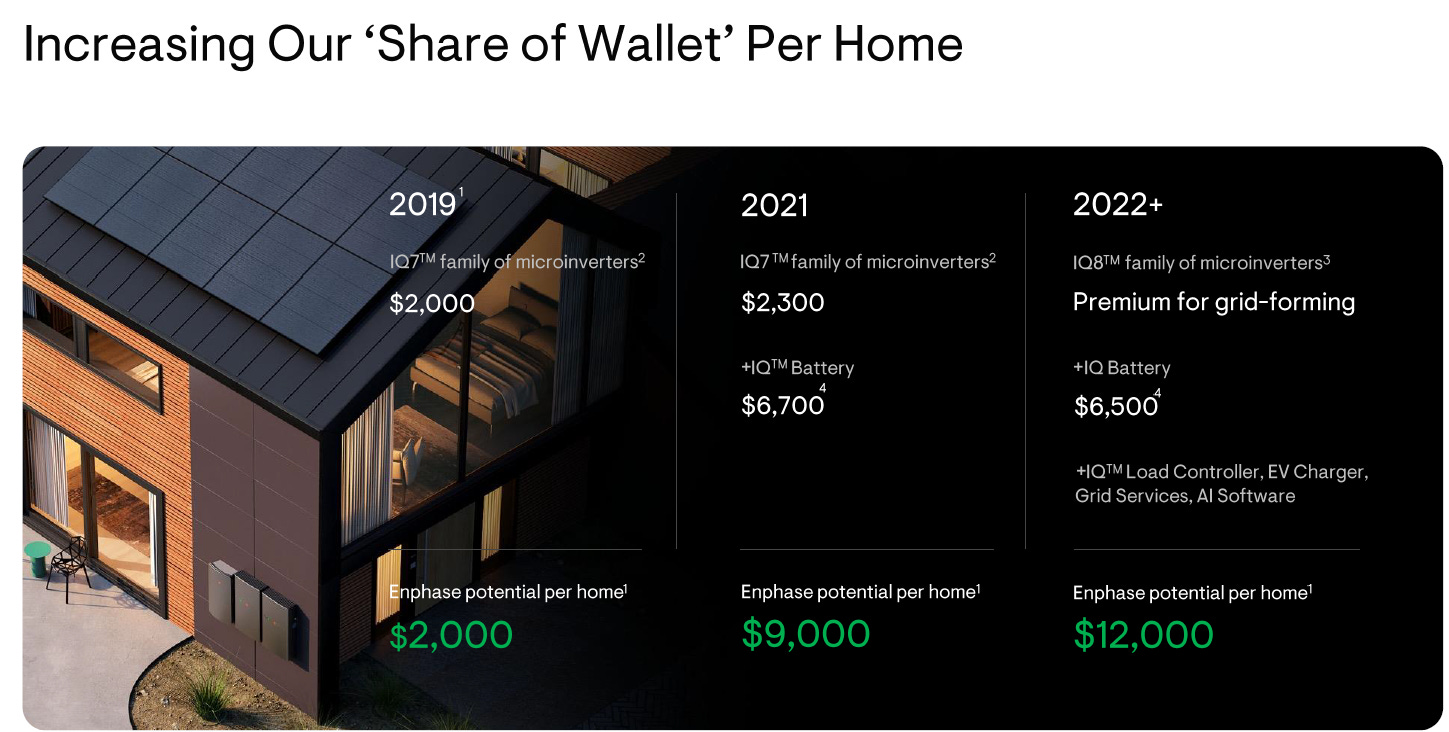

Although the company is a leader in the microinverter market, that’s only where its offering starts. I’ll share the same image here, as it deserves a lot of attention as to how the company has been developing over the years and what its current portfolio offering looks like.

Up until 2019, the microinverters were the key product in their portfolio, and the potential revenue per home was ~$2,000. Since the introduction of the IQ battery, load controller, EV charger, Grid services, and other relatively smaller products and services, the potential revenue per home is up to $12,000.

The expansion to other products, in my opinion, is crucial for the long-term success of Enphase. It is moving from being a microinverter company to a home energy solutions company.

A traditional company focuses on the end-user only, as they are the ones who are ultimately paying for the product. Enphase is different. It aims to serve the distributors and installers, not just the homeowners.

If you look at past acquisitions, most of them aren’t related to their operations.

Instead, they’ve allowed them to create a unique Enphase Installer Platform that focuses on ease of doing business for installers, by:

Providing them leads;

Offering state-of-the-art design and proposals software;

Bringing Fintech partners to close sales (for financing);

Helping them with fast turnaround on their permits;

Seamless installation via the Enphase Installer App; and

Providing them with the 365 Pronto Tech platform to help with operations & maintenance.

Their strategy is simple: Manufacture great products & make it as easy for everyone involved in the process.

Lastly, the company offers a 25-year warranty on its microinverters (versus 10 years for many competing solutions). If someone is an installer, it doesn’t get better than this. If the company has a moat, this is it - a superior relationship with distributors and installers.

3.0 Regulation

We’ve witnessed almost a decade of changes in rules and regulations where the focus has been more and more on sustainable energy. Governments all over the world have provided subsidies and funded various projects and many companies, such as Enphase, have benefited from that.

3.1 The Inflation Reduction Act (“IRA“)

The Inflation Reduction Act (“IRA“) of 2022 aims to reduce greenhouse gas emissions, and part of it is through incentives for renewable energy (tax credits for solar, wind, and other renewable energy projects, and incentives for residential solar installation). It provides multiple provisions that directly or indirectly benefit companies like Enphase. One example is the 10% investment tax credit for its solar system components.

3.2 Net Energy Metering 3.0 (“NEM 3.0“)

In December 2022, the California Public Utilities Commission (“CPUC”) approved a new net energy metering policy, called Net Energy Metering 3.0 (“NEM 3.0“) that reduces the compensation earned by solar customers selling extra energy back to the grid by a substantial amount ($0.05/kWh to $0.08/kWh compared to the prior average of $0.25/kWh to $0.35/kWh). This change reduced the demand for solar PV systems in 2023 and may continue to do so for future inverter sales.

This is where the batteries come into play. The reduction, coupled with rising utility rates, may encourage the deployment of battery energy storage and mitigate some of the demand reductions.

3.3 Trump / Elon

Elon Musk is part of Donald Trump’s team and there’s no doubt that he’ll have influence.

Although his companies had a fair share of government support (one way or another), his current stance is against subsidies. It isn’t clear (yet) what changes are coming and whether Enphase will benefit from them or not.

How could it benefit? Only if the subsidies removed lead to smaller (or less efficient) competitors going bankrupt. Otherwise, removing subsidies would not help Enphase.

On the other side, Musk has been a proponent of sustainable energy, so it remains unclear what to expect on this front.

Enphase highlights this as a risk in their annual report:

The reduction, elimination or expiration of government subsidies and economic incentives for on-grid solar electricity applications could reduce demand for solar PV systems and harm our business.

The company has listed another risk, that relates to the U.S. trade environment:

Changes in the United States trade environment, including the recent imposition of import tariffs, could adversely affect the amount or timing of our revenue, results of operations or cash flow.

On the topic of tariffs, I find it more likely that Enphase is beneficiary than not.

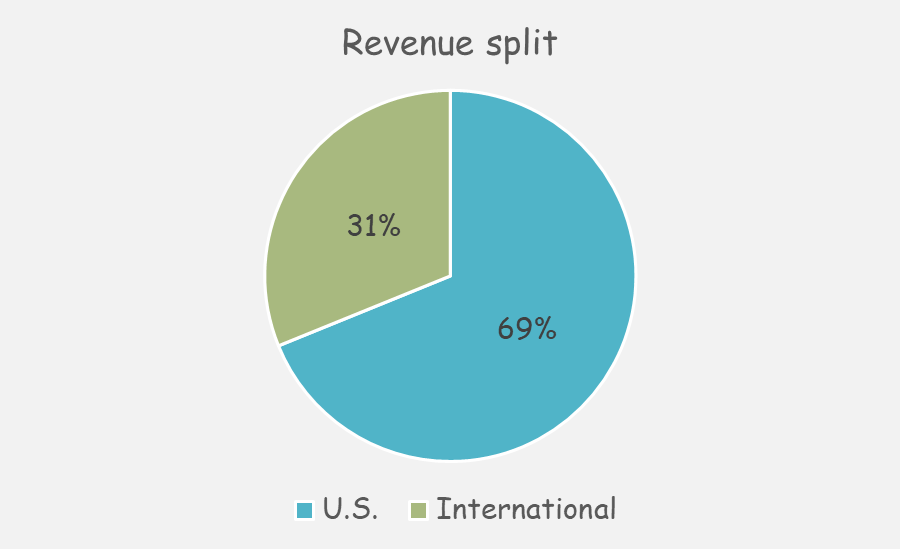

Up until this point, everything mentioned related to the United States. Especially since 31% of its revenue is coming outside of the United States.

3.4 Regulations/subsidies outside of the U.S.

The same applies to all other countries.

Countries like Germany, Italy, the Netherlands, France, Spain, and the U.K. offered generous Feed-in tariffs, paying homeowners for the solar energy they generated and exported to the grid.

Countries like Germany, Austria, and Italy had incentive programs providing financial support for integrating battery storage with solar systems.

The list continues with Australia, India, Japan, Canada, Chile, Brazil, Mexico, and many more countries, where the government has some involvement in this area. A lot of these policies have supported the growth of rooftop solar and battery storage, increasing demand for Enphase’s microinverters and IQ battery systems.

4.0 What’s next?

In the United States, it is estimated that around 4.4 million homes have solar panels (~3% of the total housing units), indicating a relatively low penetration rate, especially compared to Australia (30%), or some European countries, such as Italy (23%), Netherlands (16%), Germany (10%).

When it comes to batteries, the penetration is below 1%, with a few exceptions, such as Italy (4%) and Australia (3%).

In addition to this, the share of electric vehicles has been growing, which would only increase the demand for both solar panels & batteries.

Enphase is perfectly positioned to capture the demand that is on its way.

However, they’re not the only ones. Tesla, SolarEdge, Huawei, BYD, ChargePoint, Wallbox, and the list goes on.

This isn’t a winner-takes-all market.

5.0 Historical Financial Performance

If you see the chart below, you might think there’s a typo or a data entry error with the last twelve months (“LTM“) column, as it is roughly half compared to 2023.

There isn’t. The Inflation Reduction Act of 2022 (mentioned earlier in the post) and other government initiatives increased the demand in 2022 significantly. For this reason, the distribution partners of Enphase increased the quantity of products ordered.

From an accounting point of view, Enphase made the sale and recognized the revenue. In reality, the inventory was passed from one company to another. If the distribution partners have a significant inventory on their hands, they won’t be ordering again soon. Which is what followed:

In Q3-2023, the demand decreased in key European Markets (Netherlands, France, and Germany), and the distributors had enough inventory, so they didn’t have to order again (as much). Not that long after that, the same was applicable for distributors in other parts of the world. That trend continued until Q2-2024.

Therefore, using 2022 and 2023 numbers as a starting point would only be useful if one expects government initiatives that have a significant impact on the demand. If that isn’t the case, then the LTM numbers represent a better picture of where the company is today.

6.0 Valuation

Valuing a company in an emerging industry, with a lot of uncertainty can be fun!

So, here are my assumptions (and the rationale behind them):

Revenue - As the inventory levels have stabilized, and the market grows, the revenue growth will re-accelerate. The penetration rate of its products is low, there’s a long runway ahead. However, the 50%, 60%, or 100% revenue growth days are likely behind. Not only because the effect of the policies is almost gone, but also due to its competition. Especially in Europe, there is an increase in alternatives that are much cheaper (coming from China), and will likely take market share.

Operating profit - If you take a look at big-name analysts, the long-term operating margin expected is in many cases above 30%. I’m being significantly more conservative on this variable. I do think the competition is being underestimated and at some point, Enphase will have to compete on price and accept lower margins. Of course, I could be wrong.

Here’s the DCF model:

Based on my input, the fair value of the company is ~$8.2 billion ($60.5/share), not that far from today’s current price of $71.5.

6.1 The Bull Case

Here’s what a bull case would look like:

Enphase continues to be the leader in microinverters, with industry-leading gross margins;

The value that the company provides to installers is so high, that it discourages switching to another brand;

The rooftop solar market continues to expand, as more consumers adopt solar plus storage;

The demand for batteries continues and Enphase can capture a significant portion of it;

Enphase has become a market leader internationally (not only in the United States).

In this case, the fair value today would be ~$100/share.

6.2 The Bear Case

On the other side, here’s what a bear case would look like:

Competitors catch up to Enphase, and its position as leader is no longer there (the microinverter innovation cycle is a few years);

Current policies in the U.S. and internationally (such as net metering, and fixed customer charges) are altered as penetration rises, harming customer economics and slowing industry growth;

Cheaper alternatives (especially from China) dominate the international markets, squeezing Enphase out, or forcing it to reduce prices, which in turn, decreases margins;

In this case, the fair value today would be ~$45/share.

I hope you enjoyed this post, feel free to share your thoughts.