1.0 Introduction

Etsy started by brilliantly carving out a niche in handmade and vintage goods, but now it faces challenges that threaten its unique spot in e-commerce and I’ll argue it is going down the path to a dangerous spiral.

The idea to connect buyers with sellers of handmade/vintage goods is amazing, and there’s no doubt that there is demand for it.

Any marketplace has two important metrics:

The Gross Merchandise Value, also known as “GMV”, represents the value of all products sold through the website. Etsy decided to use Gross Merchandise Sales (“GMS“), which is just a different term.

The take-rate represents their share of the GMS.

The company has significantly benefited from the pandemic, as can be seen from the chart below.

However, since the pandemic peak, Etsy has experienced a decline and the lack of growth is either a lack of demand or a lack of supply in the marketplace.

2.0 The real problem

The company discloses the number of active buyers and sellers, and together, they paint quite a picture.

The number of active sellers continued to grow, but the number of active buyers didn’t.

Economics101 teaches us a simple lesson: If the demand is stable, and there is an increase in supply, the prices will decrease.

Economics also teaches that lower prices would attract more buyers, increasing the demand.

So, where are the buyers?

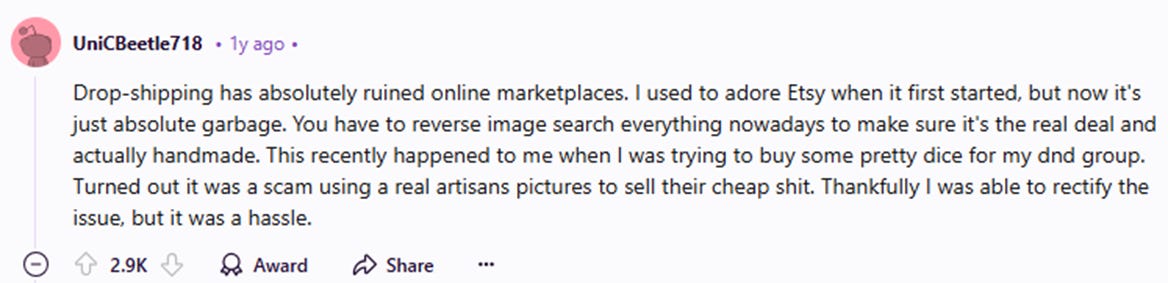

I believe the following Reddit comment summarizes it perfectly:

As Etsy doesn’t (and cannot) check the quality of all the products, more and more AI-generated product images combined with dropshipping flood the market.

The U.S. sellers used to contribute over 75% of Etsy’s revenue a decade ago. Now, it’s down to ~50%.

I’ll argue that this might lead to a spiral that will harm Etsy in the long run, with the events being:

Increase in low-value products on Etsy.

The low-value products will be perceived as a better deal when compared to the high-value products as they are cheaper.

The sellers of high-value products will sell fewer products, and some of them will eventually leave Etsy.

The buyers will be disappointed by the low-value products and will not use Etsy as much (or at all).

A part of this spiral is already visible in their net seller/buyer GMS retention.

The only time there was an increase was during the pandemic. The decline is serious.

3.0 What is Etsy doing?

Etsy is spending ~30% of its revenue on Marketing and has even engaged in TV ads to raise awareness and bring new customers.

Over the last few years, the company has been spending $700-800m per year, only to keep the revenue flat. It is accepting the fact that buyers will be disappointed, and the strategy is to replace them with new ones.

4.0 The take-rate

The only other way for Etsy to grow its revenue is to increase its take-rate, and its share of the GMS.

The company splits its revenue into two groups:

Marketplace revenue (~73% of total) - These are required fees that cannot be avoided (Transaction fees, payment processing fees, listing fees).

Service revenue (~27% of total) - These are optional, such as on-site advertising, shipping labels, etc.

Its take-rate is incredibly high at ~21%, double from a decade ago.

For comparison, eBay’s take rate is ~14%.

5.0 Terrible management decisions

As the company was reaching its peak, the management decided to make 3 large acquisitions:

Reverb (Aug 15th, 2019) - A marketplace for new, used, and vintage music gear was acquired for $270 million.

Elo 7 (July 2nd, 2021) - Also known as the “Etsy of Brazil”, a Brazil-based marketplace for unique, handmade items was acquired for $212 million.

Depop (July 12th, 2021) - a global fashion resale marketplace was acquired for ~$1.5 billion.

It is important to note that Depop had an annual revenue of $70 million! No, this is not a typo. Etsy paid over 20x its revenue to acquire Depop!

Well, not that long later, in Q3-2022, the company recorded impairment charges of over $1 billion for Depop and Elo7. No better way to destroy shareholders’ value quickly, than by overpaying for an acquisition.

A year later, in Q3-2023, Elo7 was sold at a loss.

6.0 Historical financial performance

Historically, this is still an impressive growth. Its gross margin remains stable at ~70%.

To dive deeper into the operating margin, it would be best to look at the 3 key operating expenses:

The increase in marketing expense (as % of revenue) has already been highlighted in the previous section. It is necessary to maintain the buyers’ base. So potential future improvements in the operating margin can only arise by decreasing the product development and general & administrative (as % of revenue).

7.0 Valuation

The two key variables when it comes to valuing a company are:

Revenue - Given that the number of active buyers hasn’t grown in the last few years, it is difficult to expect revenue growth above inflation.

Operating margin - I do think there’s room to improve the margins by reducing product development and general & administrative (as % of revenue).

Here’s my DCF model:

Based on my input, the fair value of the company is $3.2 billion ($29/share). This is significantly lower than the current market cap of $5.7 billion ($51/share).

Anyone betting on ETSY 0.00%↑ is ultimately betting that:

The number of low-value products will decrease over time.

The number of buyers will start growing again

Etsy can continue increasing its take-rate, without losing sellers of high-value products.

The management will not engage in acquisition (as they are clearly bad at it).

I hope you enjoyed this post, feel free to share your thoughts.

Based on my input, the fair value of the company is $3.2 billion ($29/share). This is significantly higher than the current market cap of $5.7 billion ($51/share). -> I believe it should say ‘lower’ rather than ‘higher’.

Great analysis