1.0 Introduction

From winning a business plan competition to $2.5 billion of revenue and over 40 million monthly users.

In 12 years.

How did Grab pull this off, and what’s next?

2.0 History

2.1 The Spark

Meet Tan Hooi Ling.

She worked long hours for McKinsey in Kuala Lumpur and often had to take a taxi home late at night. Because the taxis weren’t considered safe, her mom would wait at home, worried.

To make this journey a bit less worrying, they developed a “manual GPS system.” Tan would text her mom the car number plates and continue messaging her about the location throughout the journey.

She was an extraordinary employee, and McKinsey sponsored her MBA education at Harvard Business School.

That’s where she met a fellow Malaysian named Anthony Tan.

In 2011, Anthony took this frustration into a winning business plan for Harvard Business School’s New Venture competition.

Whether Tan Hooi Ling was involved in it is unclear.

The idea was simple: Use technology to make taxis safer in Malaysia by connecting drivers and customers.

A year later, MyTeksi was born.

Both of them became co-founders, but Tan Hooi Ling had to return to McKinsey after graduation to serve her bond with the consulting firm, one of the conditions of her education sponsorship.

She returned to the company in 2015, became COO, and remained there until 2023. Her contribution was crucial for the success of the company.

The following Q&A video is a year old and is a good introduction to Grab’s culture.

2.2 The expansion

Over the next few years, the MyTeksi rebranded to GrabTaxi and then eventually to Grab. It expanded to the Philippines, Thailand, Vietnam, Singapore, Malaysia, Cambodia, and Myanmar.

But geographical expansion wasn’t enough.

The expansion was vertical as well. In 2017, Grab acquired an Indonesian online payment start-up (Kudo), which was integrated into Grab’s payment system.

In 2018, it acquired Uber's Southeast Asia operations. This event was essential to speed up the food delivery part of the business. GrabFood and UberEats were now on the same team.

Grab also explored the financial industry, partnering with Singtel (Asia’s leading communications technology group) to form GXS Bank, a joint venture that received Malaysia’s digital banking license.

The foundation of the 3 segments was laid down: Mobility, Delivery, and Financial offerings.

2.3 More of the same?

However, most news in the last 8 years felt like brainstorming sessions on creating more of the same.

The delivery segment now offers GrabFood, GrabMart, GrabKitchen, GrabExpress, GrabKios;

The mobility segment offers GrabCar, GrabTaxi, GrabPet, JustGrab, GrabBike, GrabTrike, GrabThoneBane;

The financial offerings segment offers GrabPay, GrabRewards, GrabFinance, GrabInsurance, etc.

I’d argue that creating niche solutions is a great way to increase brand awareness, which in turn leads to increased demand.

Having this broad offering is also beneficial for the company's key stakeholders, the delivery partners.

They can switch between food delivery, parcel delivery, ride-hailing, and groceries. This is the company’s competitive advantage over pure-play food delivery or ride-hailing businesses.

But wait, where’s the innovation?

2.4 The new stuff

The new portfolio additions worth mentioning are GrabMaps and GrabAds.

Is this innovative?

It is not innovative or groundbreaking, but it is brilliant for further monetizing the existing data and technology. Although this is still a relatively small segment of the company’s revenue, it comes with high margins.

GrabMaps is their in-house mapping and location-based technology that started in 2017, as Google Maps wasn’t good enough for Southeast Asia’s chaotic streets. In 2022, it was launched as a business offering, and it leverages its own drivers and delivery partners that make millions of consumer trips.

GrabAds is not only part of the App experience. It is also part of the in-car engagement (flyers, screens, driver chats) and mobile billboards (Grab’s cars, bikes, well, whatever moves).

These pieces often fly under the radar.

3.0 The key numbers

3.1 Monthly transacting users (“MTUs”)

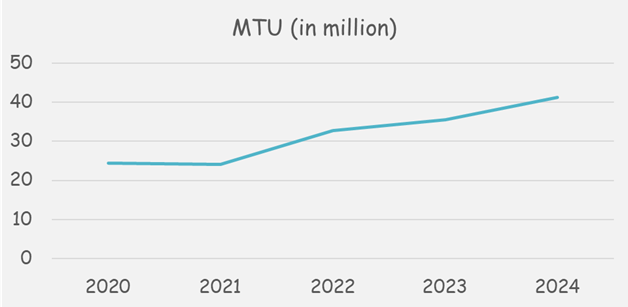

For the number nerds among you, this will be a fun section. Let’s start with the MTUs.

The company passed 40 million MTUs in 2024. To put this into perspective, Southeast Asia has a population of ~670 million, which would lead to a penetration rate of ~6%.

Uber has 44 million users in the U.S. (out of a population of ~340 million), leading to a penetration rate of ~13%.

So, does that mean Grab has room to double? Or will the growth be less than double, as Southeast Asia is not as developed as the U.S.?

In my opinion, the 2x room to grow its number of users is a fair estimate, given that Grab also has the financial segment.

Is this enough to value Grab? No. That’s one piece of the puzzle.

Grab lags in monetizing users. By that, I mean that over time, as the adoption increases, it will be more frequently used by new users and existing ones.

On top of that, there’s the increased monetization of GrabMaps and GrabAps. My best estimate is that this will double the top line.

Doubling the users + doubling monetization = quadrupling revenue in the long run.

3.2 Revenue

The past performance of the company (and the management) gives confidence that this is possible.

The company’s revenue in FY2024 is 6x the revenue of FY2020 and the growth spans across all categories.

3.3 The margins

The last part to follow is the margins. There are a few ways to look at it.

You can follow the Segment-Adjusted EBITDA, which excludes some expenses, such as regional corporate costs and share-based compensation.

You can follow Adjusted EBITDA. You can follow gross margin. You can follow the operating margin.

I use two metrics:

Operating margin - to understand the big picture.

Segment Adjusted EBITDA - to understand the development in each segment. Yes, you could argue that adjusted metrics aren’t useful, as they do not capture all of the expenses. This is true, but I still find them partially useful. They help in understanding whether an individual segment is improving or not. After all, the year-over-year comparison brings value to the table.

Grab is about to break even, with its operating margin being -6% in 2024, compared to -22% in 2023 and -96% in 2022. The path to profitability is clear.

In January 2025, Grab and BYD entered a strategic partnership to expand EV fleet offerings across Southeast Asia. This will bring up to 50,000 BYD EVs to Grab’s driver-partners, and increase the availability of green vehicles to Grab users.

4.0 Ownership

The company has a dual-class share structure.

Each Class A share carries one vote, and each Class B share carries 45 votes.

This structure allows Anthony Tan to have more than 50% of the voting power while owning less than 4% of all outstanding shares.

Key shareholders include:

SVF entities (managed by Softbank) - 14%

Uber Tevnologies - 14%

Toyota Motor Corp - 6%

Morgan Stanley - 5%

Didi Chuxing - 5%

In theory, when valuing a company with a structure of this kind, a discount is applied for the lack of control, as Anthony calls the shots.

5.0 Capital allocation

As I write this, the company has $3 billion in cash and $3.5 billion in short—and long-term investments. Apart from leases, it has no debt on its balance sheet.

This, combined with the improving margin, gives management peace of mind that the company has no liquidity issues and no risk of going bankrupt.

However, holding a lot of excess cash also puts pressure on the management to allocate it.

Grab has historically acquired other companies, and I think this can be expected going forward. There were rumors of a potential merger with GoTo, a smaller Indonesian rival. Besides the approved $500 m repurchase program, it is unclear where the excess cash will be allocated.

6.0 Valuation

Earlier in the post, I shared my assumption about the revenue growth (4x over time).

What about the operating margin?

Uber is the only key player with a positive operating margin of ~6%, and its management has guided it toward a long-term operating margin of 15%.

The fact that Uber is the only player with a positive margin shows how difficult it is to be profitable in this industry. It is likely that a winner (or two) takes all, per geographical region. I believe Grab is the one for Southeast Asia and is following Uber’s footsteps in terms of margins.

However, this is still uncharted territory, so I’m using a 12% operating margin in the long run, as an estimate.

Here’s my DCF model:

Based on my input, the company’s fair value is ~$16 billion ($3.9/share), slightly below today’s market cap of $18.4 billion ($4.6/share).

This is without applying a discount due to a lack of control.

6.1 The Bull Case

Here’s what a bull-case would look like:

Continuous user growth and market penetration, above the 12% assumed;

Successful monetization of GrabAds and GrabMaps;

Become a winner in Southeast Asia and have pricing power in the long run, which would lead to an operating margin above the projected 12%; and

Acquisitions that bring synergies to the table and create more value;

In this case, the fair value would be closer to $7/share.

6.2 The Bear Case

On the other side, here’s what a bear case would look like:

Stagnant user growth and market saturation hindered by rural under-penetration;

Underperformance of GrabAds and GrabMaps;

Significantly lower operating margins than Uber; and

Acquisitions that destroy shareholders’ value;

In this case, the fair value would be closer to $2/share.

If you found this deep dive valuable, consider sharing it with someone who would too. Your support helps grow The Finance Corner and brings more deep dives like this to your inbox.