Deep dive into Greggs

Undervalued Money Printing Bakery

1.0 Introduction

When you think of a world-class business, your mind doesn’t jump to sausage rolls. But it should.

Greggs is one of the most disciplined companies I’ve stumbled upon, both from a business perspective and in terms of capital allocation.

Back in 1939, John Gregg offered a small-scale delivery service, using his bicycle, to distribute yeast, eggs, and bread to local families. This marks the modest beginning of a company that today has a market capitalization of £2 billion.

In 1951, the transition to a physical retail presence was marked by the opening of the first Greggs shop. Today, it has more than 2,600 shops.

2.0 What is Greggs?

Greggs has grown to become the leading UK bakery chain, offering a wide range of goods (pastries, pizzas, sandwiches, doughnuts, cakes, coffee, etc.).

Of course, shoutout to its most popular product, the sausage roll.

Here’s the company’s description of this incredibly innovative product:

Much like Elvis was hailed the King of Rock, many have appointed Greggs as the (unofficial) King of Sausage Rolls.

Freshly baked in our shops throughout the day, this British classic is made from seasoned sausage meat wrapped in layers of crisp, golden puff pastry, as well as a large dollop of TLC. It’s fair to say, we’re proper proud of them.

Are these exciting products? Depends on how hungry you are.

Yet, the company has a lot to teach us. After all, it has:

730,000+ Facebook followers

200,000+ Instagram followers

61,000+ members in the “Greggs Appreciation” subreddit.

Additionally, numerous content creators share videos reviewing the menu, and they get quite some views.

Is it just a bakery chain? It feels like more than that.

So, where do we start?

3.0 The tough decision

I want to go back to 2013, when the then-CEO, Roger Whiteside, made some tough decisions. He noticed that 80% of the business was food-on-the-go (“FotG“), and decided to only focus on that. So, the sale of bread and scones was discontinued in many outlets. Giving up 20% of the business is definitely a tough decision.

Why would he do that? He wanted all the focus on the commuters.

The breakfast menu was significantly expanded, and the operating hours were extended.

During his time (until 2022), the company made a few introductions, such as:

(2014) Greggs app

(2017) Greggs Drive-Thru

(2020) Home delivery through Just Eat

(2020) Supermarket partnerships - Asda, Tesco, and later Sainsbury’s

Today, Greggs has a variety of shops:

Traditional high street shops

Convenience-driven locations & Drive-Thrus

24-hour trials

Outlet stores

Franchise partnerships

Supermarket concessions

Digital fulfilment channels (Uber Eats / Just Eat)

All of these decisions contribute to the company's reputation, which is built on providing freshly prepared products and convenience.

4.0 The growth (and economies of scale)

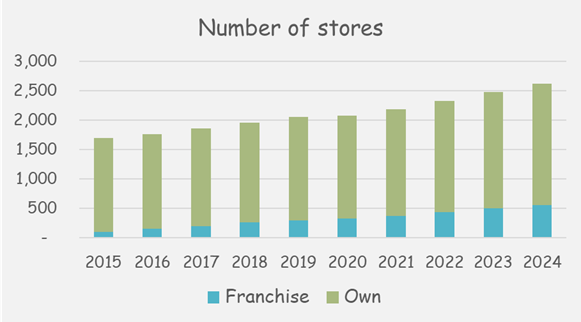

On average, the number of stores has been growing by ~5% per year.

Franchise partnerships were introduced in 2012, and today, they represent ~20% of all locations.

What is interesting is that over the last decade, the number of company-operated (“Own“) stores increased by 464, while the number of franchise stores increased by 456. The growth is coming from both directions, at the same pace.

4.1 Economies of scale

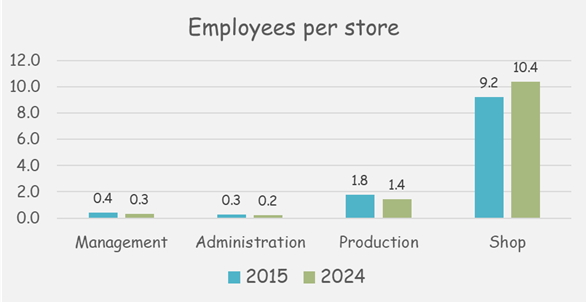

Greggs provides a breakdown of its employee numbers by four categories. Here’s the split as of the end of 2024:

Management: 789

Administration: 512

Production: 3,747

Shop: 27,210

This vertical integration is a key competitive advantage, enabling it to control the quality and cost of its product range.

It’s always interesting to see what these numbers look like over time, per store, so here’s a comparison:

This is what economies of scale look like. The number of locations increased by 54% over this period, while:

Management employees: +11%

Administration employees: +13%

Production employees: +24%

Shop employees: +74%

If you’ve noticed the significant increase in “shop employees per store,” good job!

This is the outcome of extending business hours and some locations being open 24 hours. This is also the reason why the revenue is up 140% over the same period and the operating profit is up 167%.

Additionally, in 2024, a new national manufacturing and distribution centre in Derby was opened, providing increased manufacturing capacity for frozen products and enabling efficient storage, picking, and distribution of frozen goods. All of which is important for the company’s long-term growth.

5.0 The Historical Financial Performance

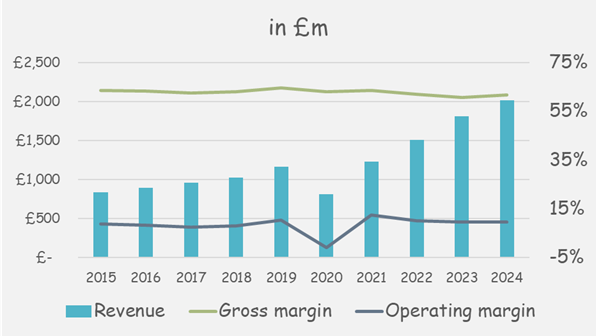

The following chart is quite boring. In investing, boring can be a good thing.

The gross margin remains stable at ~62%, and the operating margin slightly improved over time (8.8% to 9.7%).

There is no doubt that this is a cash-generating machine, which raises the following question: What happens to the generated cash?

5.1 The capital allocation

Over the last decade, the company’s free cash flow (operating cash flow reported, minus leases, minus capital expenditures) was £554 million.

Almost all of it (£493 million) was paid out as dividends. No acquisitions, no risks taken. Just doing more of what works.

This brings us to the next question: its dividend policy.

If we exclude the pandemic, the regular dividend was ~44% of the company’s earnings. Which, on the current share price, results in a dividend yield of ~3.5%.

But, as you can see, once in a while, there’s a “special dividend”, which is quite significant. When this is taken into account, the payout ratio is closer to ~60%.

Not paying out everything as dividends right away gives management the freedom to make capital investments they believe are in the best interest of the company in the long run. Once excess cash is accumulated, a special dividend emerges.

The only thing I dislike is that there is no debt (apart from leases), which is deeply ingrained in the company’s DNA.

6.0 Valuation

Based on my analysis, the future business performance of Greggs is unlikely to be significantly different from its past performance, meaning:

~60% of all the earnings to be distributed as dividends, and ~40% to be used for (locations’) growth.

Operating margin to continue slowly increasing over time, due to economies of scale; and

Revenue growth to continue due to the increase in the number of locations and inflation.

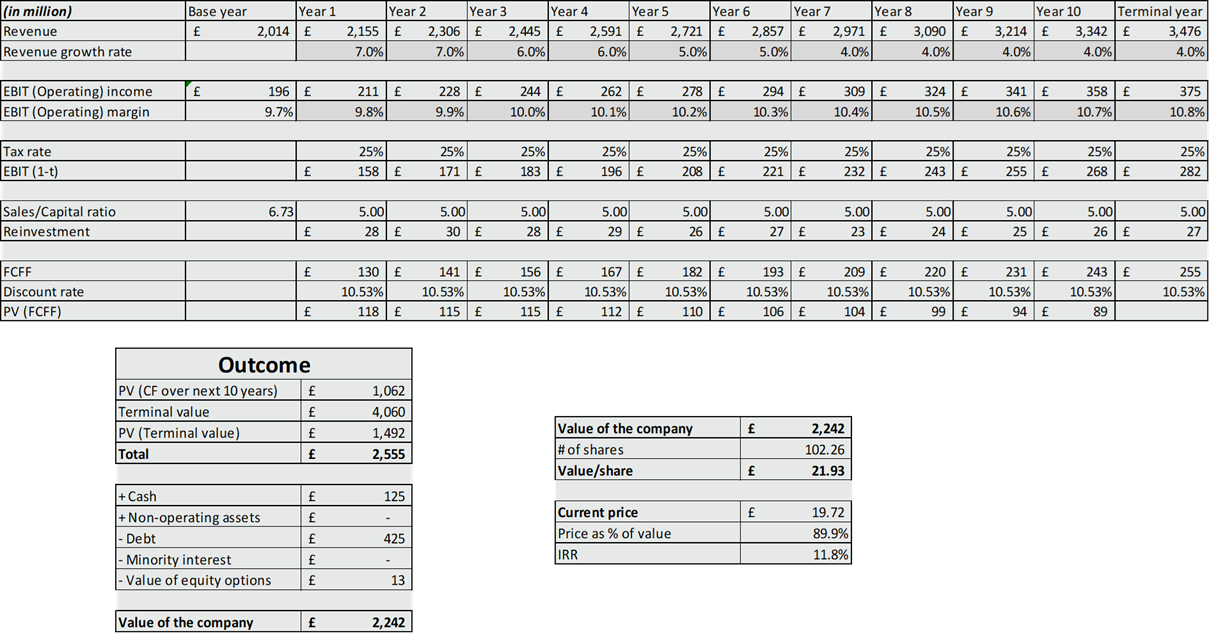

Here’s my DCF model, based on the above assumpions:

The company’s fair value is ~£2.2 billion (£22/share), roughly 10% higher than the current price.

This is without assigning any premium for its quality, which I believe it deserves. The valuation would further increase if the future growth is funded by debt.

Disclaimer: As I am writing this post, I have no position in the company.

This isn’t a hyper-growth company. This is a boring, defensive one that takes no risks.

7.0 The community

I want to wrap this post with a focus on the community.

First of all, Greggs shares 10% of its annual profits with its employees, which is a rare practice.

Additionally, the Reddit posts are largely positive. For example, a month ago, someone shared their review on a new product.

Just a bakery? I don’t think so.

Thanks for the write-up

One comment though - it seems you extrapolate growth from the past (kind of)...

However, they have been explicit about spending and ramping up for further expansion - they are currently pursuing a supply chain capacity expansion for supporting up to 3,500 stores.

Also, maturing of new stores lifts ROIC, as well as 'store relocations'. I am not sure if or how you took these aspects into account or how they would impact your model.

What are your thoughts about shop lifting? some stores have locked sandwiches and soft drinks, but the situation still seems to worsen. it is so sad. they loose so much money daily and honest customer have to pay up for the stolen items. https://www.express.co.uk/news/uk/2052365/panic-greggs-staff-use-bike-locks-on-fridges