1.0 Introduction

Kellogg is a great example of a company with a rich history, that started by mistake. For that reason, I’d like to start this post outlining its history, before we dive deep into the company of today (or what is left out of it).

There’s no doubt that the name “Kellogg” comes with a recognizable brand and many of its products are being used on an almost daily basis.

Let’s get started!

2.0 History

2.1 The mistake

Back in the 1870s, John Harvey Kellogg became the manager of an institution named Battle Creek Sanitarium which became a world-famous health resort. His brother, Will Keith (W.K.) Kellogg worked as a bookkeeper, but also assisted John in research, to improve the vegetarian diet, especially in the search for wheat-based granola.

One night, John Kellogg accidentally left a batch of wheat-berry dough out after being called away. Rather than throwing it out the next day, he sent it through the rollers and was surprised by the delicate flakes, which could then be baked. This mistake was the beginning of a multinational food manufacturing company.

The guests enjoyed it so much, that the flaked wheat was packaged and mail-ordered to them after they left the Sanitarium. However, John forbade his brother to sell the cereal beyond his customers. This indicates he wasn’t entrepreneurial enough.

2.2 The brothers go to a legal battle

W.K. Kellogg, on the other side, recognized its potential and started his own company in 1906 named Battle Creek Toasted Corn Flake Company which was not that long after renamed to Kellogg Toasted Corn Flake Company. Despite convincing his brother to relinquish rights to the product, John filed a suit against the company, for the right to use the family name. This legal battle eventually ruled in W.K.’s favor.

In 1922, the company was renamed to the Kellogg Company.

In 1931, as the U.S. was experiencing the great depression, the company announced that most of its factories would shift towards 30-hour work weeks, so that an additional shift of workers could be hired, to support through the depression era. This policy remained in place until World War II.

2.3 The growth

The first non-cereal product was introduced almost 6 decades later.

It was 1964, and the product was a pastry that could be heated in the toaster. The name chosen was Pop-Tarts.

While all their competitors were focused on marketing similar products to children, Kellogg Company decided to go after the baby boomers and make it appealing to adults. This turned out to be the best way forward that allowed them to expand internationally as well.

This marketing approach, combined with acquiring smaller companies, allowed them to continue to grow, despite some Wall Street analysts labeling it as a fine company past its prime. The strategy to grow organically through marketing and innovation, and acquire other companies did not change over the years.

2.4 Splitting the company into two

On March 2023, it was announced that the company would split into two separate public entities, to focus more effectively on distinct markets:

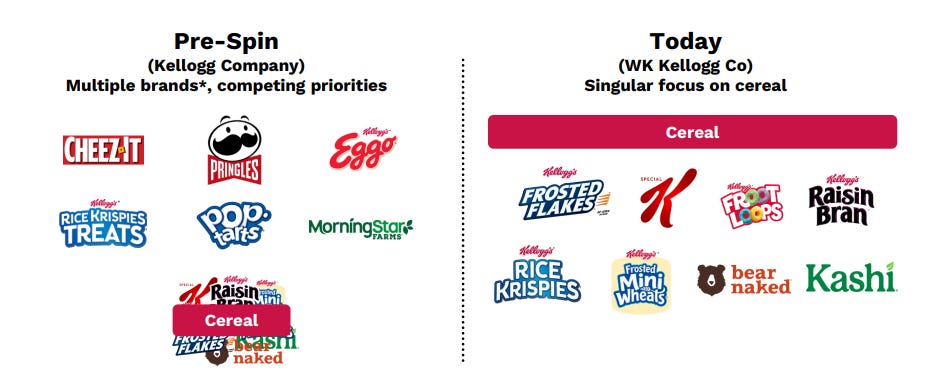

Kellanova - Focuses on the global snacking, frozen breakfast, and plant-based foods portfolio. With brands like Pringles, Cheez-It, and Eggo, Kellanova’s strategy centers on global expansion, product innovation, and meeting the growing demand for convenient, indulgent, and plant-based foods. It continues to trade on the New York Stock Exchange (“NYSE”) under the ticker “K.”

WK Kellogg - Focused on the North American cereal business. It will operate independently, managing a portfolio of famous breakfast brands like Frosted Flakes, Special K, and Raisin Bran. The mission is to revitalize the cereal category through product innovation, marketing strategies, and health-conscious offerings and trades under the ticker “KLG” on the NYSE.

In October 2023, the split was finalized. One could make a case that there’s a rationale behind this. But there was another event in the background.

2.5 Mars acquiring Kellanova

Only nine months later, in August 2024, Mars announced it would acquire Kellanova for $83.5 per share in cash, totaling ~$35.9 billion, representing a premium of around 44%.

If anyone has been involved in large acquisitions, then you’re aware it takes a lot more than nine months for a transaction of this kind, from start to completion. It is far more likely that the split happened during the negotiations or due diligence, either because Mars wanted only that portion of the business, or because the management wanted to keep the WK Kellogg name alive (or both).

Since the announcement, the Kellanova share price has been flat, without much room for arbitrage, meaning that the market expects the deal to go through.

So, what is left as a public company is WK Kellogg, the North America-focused cereal business.

From this moment on, everything that you read relates to WK Kellogg.

3.0 WK Kellogg

WK Kellogg kept ~18% of the original Kellogg Company’s revenue and many valuable brands.

The company has built many characters over time that help in executing the marketing campaigns, such as Tony the Tiger (Frosted Flakes), Toucan Sam (Froot Loops), and Snap Crackle and Pop (Rice Krispies).

In fact, Gary H Pilnick, the CEO, had some of the characters behind him, during his CNBC interview as the company spun off:

4.0 What to expect?

In one of the recent presentations, the management provided insights into their short-term goals:

Stabilize topline - Over the last quarters, the revenue has been decreasing by ~3% on average, which is definitely not great news, considering that this is a mature, stable business. There will be more on this in a bit.

Improve margins by improving operating efficiency and reliability - After the spin-off, there is still some integration that needs to take place, that will provide better end-to-end process and execution. The management expects to have ~5% higher margins in the future.

Use the excess cash to pay down debt - Its debt is ~30% of the company’s market cap. Although it isn’t at a point that poses a significant risk, it is quite clear that the management wants to be conservative on this aspect. Their aim is to keep the long-term debt below 2.5 times the adjusted EBITDA and they are almost there.

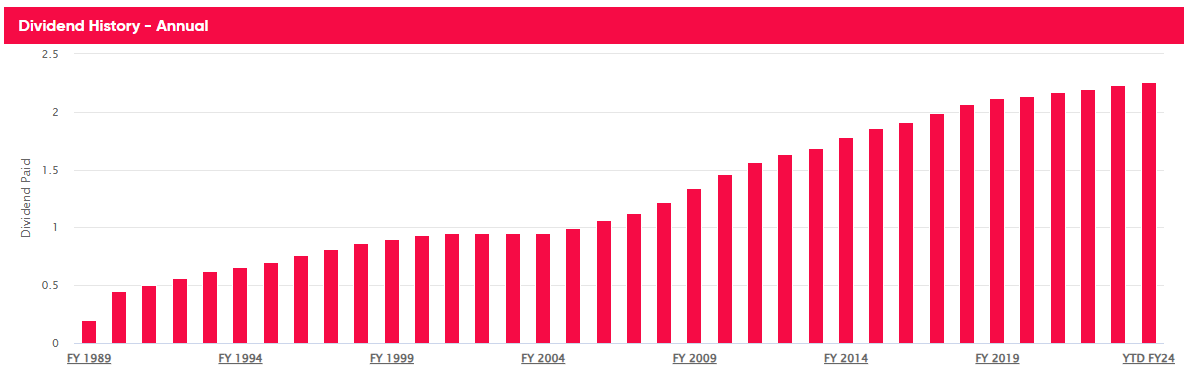

Continue to pay an attractive dividend (current yield is ~3%) - This is likely a legacy policy that has been passed on from the previous company and will remain the case. Below is a graph of what the dividend growth used to look like prior to the spin-off.

Between 1989 and 2024, the dividend increased 10x, implying an average growth of ~7%.

This might sound impressive, but in the last 5 years, the dividend increase has been closer to 2% per year.

Given there are a lot of challenges and priorities, I don’t see any reason to expect high dividend growth in the coming years.

5.0 Historical Financial Performance

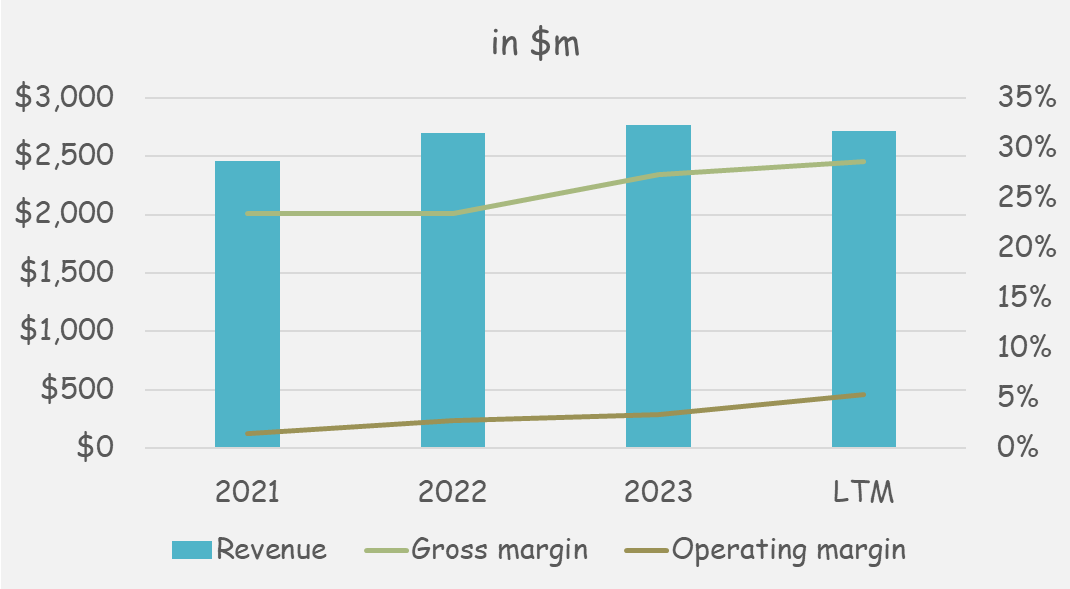

Since the spin-off occurred recently, only a few years of historical data are available.

The average growth over the last few years has been below the inflation rate, which is strange given that this is not a discretionary product. On the other side, the margin is quite low, as it includes separation costs related to the spin-off.

So, why is this the case? One key reason is the increased pricing of these products which isn’t justified by the perceived value from the customers.

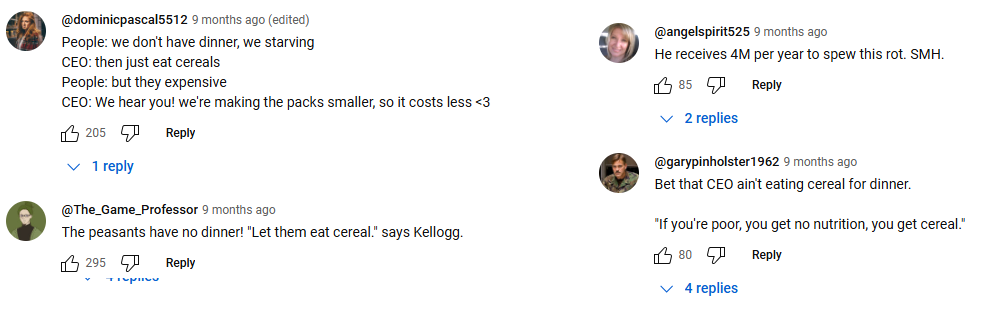

A great example is this interview with the CEO that was published ~9 months ago.

Take a look at the top comments.

The sentiment around the company is not great.

One variable that is partly outside of the management’s control is the cost of its raw materials (corn, wheat, rice, vegetable oils, sugar, cocoa, fruit, nuts, packaging materials, etc.).

In 2024, the cost of some raw materials, such as corn and wheat, has gone down, while the cost of others, such as rice and cocoa has gone up. Companies of this kind oftentimes have a futures contract, to secure the raw materials at a certain time at a pre-determined price. What that means is that the price change will not be reflected in their income statement when the price of the raw material changes.

It is worth noting that their top 5 customers account for almost 50% of their sales, with Walmart accounting for 26% of them. Although this can be labeled as a risk, I’ll argue it is not really the case, as Walmart has no incentive to replace a brand that is loved by many, with an unknown brand.

6.0 The worrying numbers

The revenue has slightly decreased over the last quarters and it is important to understand what drives that decrease.

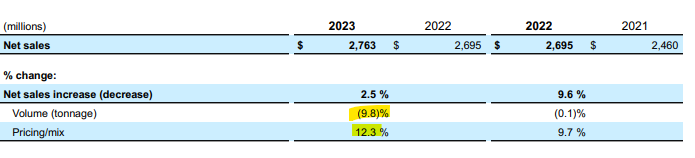

But first, let’s go back to 2023 when there was still some revenue growth.

In 2023, the revenue increased by 2.5% as the price increase was greater than the volume decrease. However, selling ~10% less products is quite significant.

A likely explanation is COVID-19. During 2021/2022, more people were staying at home, and they had breakfast at home more often than they would otherwise have. Therefore, the demand for Kellogg’s products was temporarily higher.

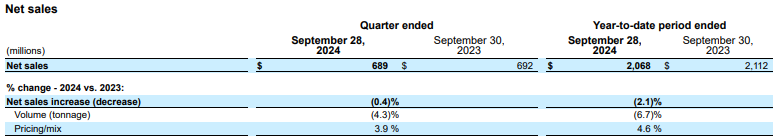

Moving forward to the last quarters, it doesn’t look as if the demand has stabilized.

In the first 3 quarters of 2024, the revenue went down 2.1%, but the volume decreased by 6.7%! If there was no volume decline, then the expected growth would not be far from the inflation rate.

The question is - where is the bottom when it comes to volume?

7.0 Valuation

I start with the assumption that the cereals market doesn’t grow above inflation over time. After all, this is a mature market and I don’t expect that it becomes the dinner go-to-meal. Therefore, my assumptions are:

Revenue - Growing at 3%/year, but not right away - I’m expecting that it will take 2 more years until the bottom is here and the inflated base from COVID-19 normalizes.

Operating margin - increase by 4% (slightly below management’s expectations) bringing it closer to the industry average. The current margin is too deflated, as it includes separation costs related to the spin-off from Kellanova.

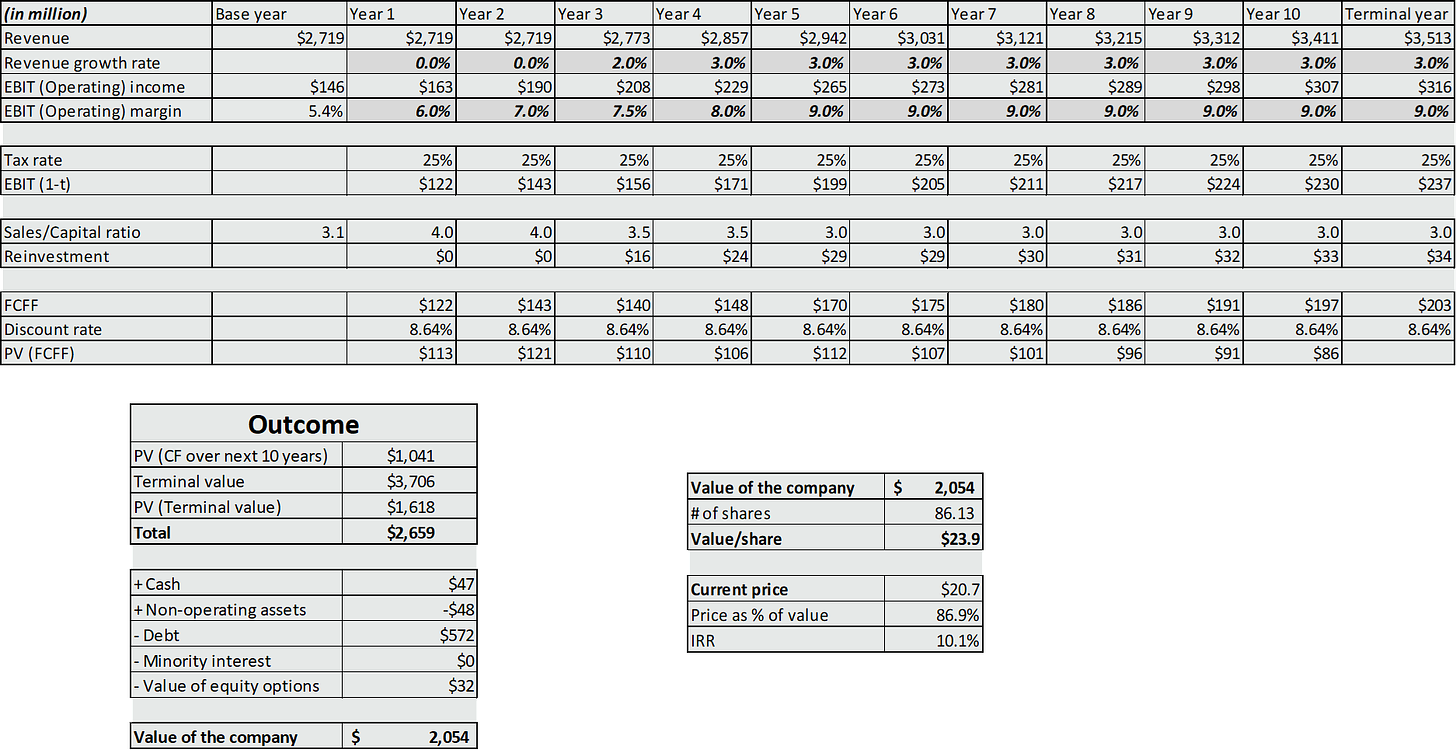

Here’s the DCF model:

Based on my input, the fair value of the company is ~$2 billion ($23.9/share), not that far from today’s current price of $20.7.

This implies that the market’s current expectations are that either the company will grow its top line below 3% per year, or the margin improvement will not be as high as the management is expecting.

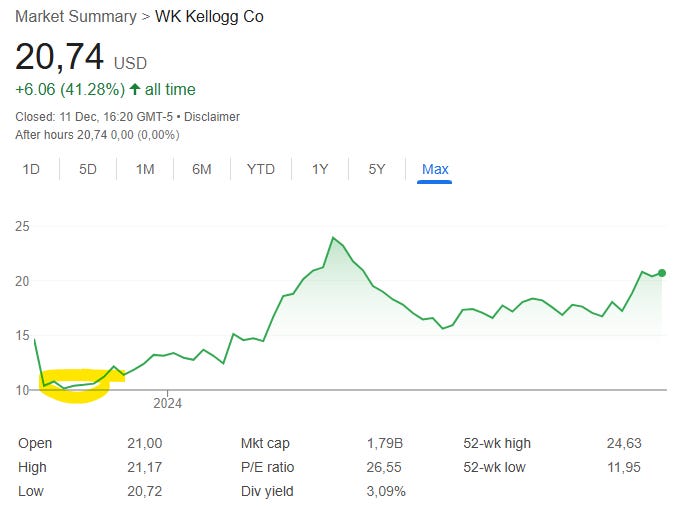

Not that long ago, at the end of 2023, the share price was ~$10.

7.1 The Bull Case

Here’s what a bull case would look like:

Improvement of the operating margin of 5% or above;

Reaccelerating growth driven by innovation & successful marketing campaign, improving the market sentiment, and allowing the company to capture a larger market share of a mature market;

Decrease in prices of raw materials;

Getting acquired at a premium (same as Kellanova).

If the management can pull this off, the fair value per share is above $30, at least 50% higher than today’s share price.

7.2 The Bear Case

On the other side, here’s what a bear case would look like:

WK Kellogg loses market shares, and the revenue continues to decline;

The new marketing strategies do not yield significant results;

Influencers (such as Mr.Beast) launch competitive products and enter the market;

Increase in prices of raw materials;

Supply chain issues.

In this scenario, the fair value per share would be close to $10, ~50% lower than today’s share price.

I hope you enjoyed this post, feel free to share your thoughts.