1.0 Introduction

Back in 2012, Manchester United became a public company, at $14/share.

Over a decade later with many ups and downs, the share price is up disappointing 18%. For comparison, the S&P500 is up over 300% during the same period, and the FTSE100 is up a bit over 40%.

The club’s financials continue to deteriorate, and I’m sure anyone who supports a sports club has plenty of ideas about what can be done differently.

The goal of this post is to elaborate on why the club is deteriorating (financially) and how I concluded that sports clubs are billionaires’ toys that serve to boost their egos.

2.0 How does Manchester United (or any other sports club) make money?

Sports clubs generally have 3 key revenue sources and here’s how the development of each one looked like for Manchester United over the last decade:

At first glance, there are a few conclusions that can be made:

The revenue has relatively low (but stable) growth over time.

Covid-19 had a significant impact on its Matchday and broadcasting revenue (as expected).

Let’s have a look at each one separately, and in each segment, try to answer the following question: How much is this revenue source depending on the fans?

2.1 Commercial revenue consists of:

Sponsorship deals with various global and regional partners - Such as TeamViewer, the main sponsor on their shirts, but also the ones shown on the advertisement boards around the field.

Merchandising, product licensing, and retail - Club-branded merchandise, including shirts, training kits, and other apparel. It also covers licensing agreements that allow third parties to produce and sell Manchester United-branded products.

The growth has been slightly below 5% per year, which isn’t that impressive and not much higher than the inflation rate throughout this period.

Is this depending a lot on the fans? Absolutely! The link to the merchandising and product licensing/retail segment is quite clear, but the sponsorship deals are also valued based on the exposure given to the companies. The more fans a club has, the more a company is willing to pay for its promotion.

2.2 Broadcasting revenue has a comparable growth, averaging 5% per year. Apart from the revenue share of the matches (Premier League, Champions League, and other competitions), this includes MANU TV, a monthly subscription that generates over £6m per year.

The drop in 2020 was driven by Covid-19, when there was temporary postponement of competition matches.

Is this depending a lot on the fans? Not always, as a significant portion of it is split equally, regardless of the club and the number of fans. However, it is dependent on the success of the club and its participation in major competitions.

2.3 Matchday revenue doesn’t need any introduction, although it had surprisingly low growth of ~2% per year, which is lower than the inflation rate.

Is this depending a lot on the fans? - Absolutely!

Conclusion: All of the 3 revenue sources have very low growth, and are dependent on the two key points:

The competitions the club participates in, and its success in them, and

The number of fans (attending the matches, paying for MUTV, buying apparel, etc.)

It is safe to say that over 70% of all the revenue is derived directly from the fans.

3.0 Key expenses

Now, let’s have a look at the key expenses and their development over time:

Employee benefit expenses - The compensation of the players, managers, staff, administration, etc.

Amortization - Anytime a player is bought from another club, the costs associated with the acquisition of the player are capitalized, and then amortized over the duration of the contract period. For example, if a player had a £30m transfer fee, and the contract length is 3 years, there will be a £10m amortization expense per year recognized in the income statement.

Other operating expenses - All the other expenses, ranging from security stewarding and cleaning at Old Trafford to property costs, maintenance, HR, professional fees, etc.

What you will notice is that all of them have been growing at a faster pace than the revenue. The key drivers behind this are the larger transfer fees and higher salaries. It is worth noting that the recent involvement of the Saudi clubs put even more pressure.

4.0 Historical Financial Performance

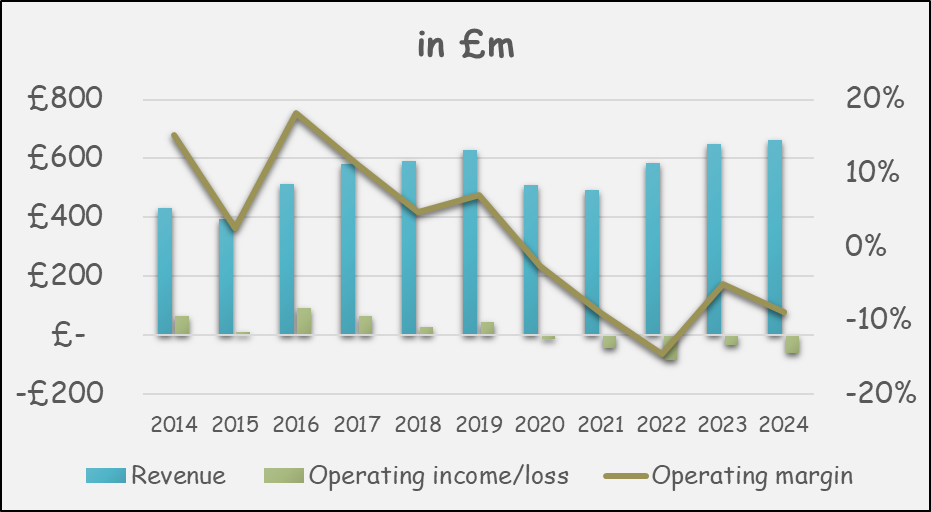

So, if we add all of this together, the outcome is the chart that was shown at the beginning of this post, low revenue growth, with significant declining profitability.

The club’s operating margin decreased from a positive 15% to a negative 10%.

This is, after all, a very competitive environment, where no single team has been at the very top for decades in all competitions. It requires significant investments (especially in players and top management), and even then, success is not guaranteed and is temporary.

So, you might ask: What is the value of a company that is not profitable, operates in a competitive field, and even success is temporary? The answer will likely be $0.

5.0 There is no value?

So, is there no value? Is one of the biggest clubs in the world actually worthless?

I’d argue that Manchester United, like other sports clubs, aren’t valued, as there’s no significant positive free cash flow. Instead, they are being priced. They are in the same group as Pokemon cards, antiques, and art paintings. The beauty is in the eye of the beholder. Except, the beholders are billionaires, and they’re likely going through a checklist.

Did I buy 5 more houses? Great, check.

How about a yacht and a private jet? Yep, got it.

Damn, there’s still a lot of money left, what should I do?

Oh, wait, what about a sports club?

The owners of a sports club (in this case, the Glazer family will make money only when they sell the club to someone who is willing to pay more than they initially paid.

6.0 The emotional side

There’s another angle that we need to explore, which is the emotional side. Some fans proudly own shares of the club, where the goal is not so much to make more money but to be a proud minority owner of the club. As such, there is nothing wrong with that.

However, there have been many examples when the stock price went up/down for ridiculous reasons. For example, there was a share price increase in 2013, due to the announcement that the club signed Fellaini. On the other side, the share price dropped ~9% on the speculation that the club might sign Ezequiel Garay. I’ll leave it up to you to decide how impactful these events are on the club’s value.

Fans will always criticize the owners/managers for the poor performance, and to a large extent, rightfully so. However, when it comes to the financial side and the share price, Manchester United is not an exception.

Take a look at the share price of Juventus, and try to guess what the spike in 2018 relates to:

If you guessed Cristiano Ronaldo, well done! Don’t get me wrong. Events like this have some (minor) impact on the success of the club during a short period of time. In the case of Ronaldo, it might even bring better sponsorship deals, higher ticket prices, and more apparel sales. However, it also comes with an additional cost (his salary!). In the long run, none of these individual events have a significant impact on the value of a football club.

Here are a few other football clubs that are publicly traded:

Sporting

Borussia Dortmund:

7.0 The transfer period

Although fans are generally emotional and excited about the club they support, the transfer period is just different. There is a lot of speculation to follow, building up the expectations for the year to come.

Well, here’s how the share price changed during the transfer period (From June 10th, to September 1st), in each year since the company was public.

As you can see, investing in Manchester United during the transfer period was a better decision than investing in the S&P500 during the same period. In fact, this return has been crushing the return of the stock since its IPO (which, as mentioned at the very beginning, is around a disappointing ~20%).

8.0 Bonus - The Credit Suisse valuation

Back in May 2015, Credit Suisse valued Manchester United, and described it as “Rare pure sports content play“. They had a target price of $23/share. Almost a decade later, the share price is at $16.5.

So, what went wrong? A LOT! Starting with incredibly optimistic P&L.

The revenue was expected to grow 9%/year, much faster than the expenses, which was the base for the DCF shown below.

Credit Suisse has made many mistakes with this model. However, the one that I find the most ridiculous is the “Terminal EBITDA multiple“. Given that the amortization of contracts is a significant expense, that actually grows over time, using a multiple without taking this expense into account is a red flag.

So, is this a terrible company to invest in? Fundamentally, yes.

Anyone who invests in Manchester United, bets that there will be a transfer of ownership, which will push the share price up. There were rumors for that back in February of 2023 when the share price went up almost double. Should those rumors come back, I do expect a movement of at least 60% from today’s share price.

I hope you enjoyed this post, feel free to share your thoughts.

This has completely missed the point that Ineos has taken a 25% stake in United and have significant governance/control at the operational level. Isn't the 'transfer of ownership' point already more or less priced in?