1.0 Introduction

Match Group is a company that continues to benefit from the society that we live in. The best way to introduce it is by sharing an image of the brands it owns.

There are estimates that it has ~50% market share in the U.S. and impressive profitability.

Not only that, but it is an incredibly resilient business. Its users are so sticky, even in the pandemic, they were around.

You might notice that the operating margin is trending down and wonder: Well, this seems concerning, is this a trend? Is it going to decrease to 20% or even 15%?

Let’s have a look at what causes the operating margin to decrease.

If we break down all the operating expenses, you’ll notice the main bucket that has significantly increased relates to Research & Development, or as they call it, Product development.

This is within the control of the company. By that I mean, the management can make a decision instantaneously to increase or decrease it. It is also a lever that can be used if there is pressure on the business from other areas.

However, more importantly, this “expense“ is expected to generate value in the future by introducing new products, or new features as part of the existing products.

The conclusion is that the current margin decrease is the outcome of a conscious management decision, and is not caused by outside pressure.

2.0 The Worrisome Society

The world is changing and the internet has a significant impact on how couples meet. What better way to illustrate that than through a chart?

Additionally, statistics indicate that fewer people are getting married. Society’s loss is Match Group’s gain.

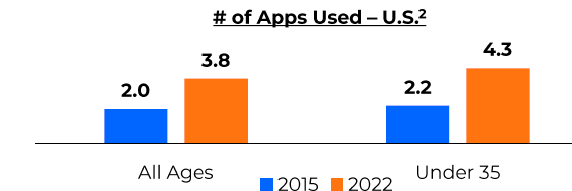

Given the behavior of the younger generation and their acceptance of technology, it is unlikely that we see a trend reversal. Actually, the younger generations are using more apps for this purpose, which will likely lead to the continuation of the unfortunate trend.

So, there are more users, using more dating apps than before, and for much longer.

3.0 The Biggest Concern - Competition

Of course, every company (and industry) has competition. Given the market share, it seems as if Match Group is winning this battle, by a wide margin. Being the biggest fish in the sea, it can create the biggest network effect. The more people use an app, the higher the value it generates for its users.

The biggest concern that many have is - Meta. As Facebook and Instagram are dominating worldwide, in theory, these apps should be able to capture a large portion of the market, quickly. However, the reality is different:

Facebook Dating was launched back in 2019 and it hasn't been a huge success.

Facebook was founded back in 2004. It has been two decades and Mark Zuckerberg has now focused on the Metaverse.

It is quite clear that targeting this market isn’t a priority for Meta at this very moment. It doesn’t mean it will never be, but the chances seem quite slim.

4.0 Valuation

Based on my assumptions, the fair value of the company is ~$14 billion ($39/share), slightly above today’s share price ($34/share).

The two key assumptions I have are:

Revenue growth of 54% over the next decade - I think this is fairly conservative. The change in demographics, combined with price increases makes this easily achievable.

Operating margin of 26% - This is slightly below their historical average.

Here’s how the valuation (per share) changes if you have different assumptions than mine:

Today’s share price of $34 implies that the market expects either:

The company’s profitability to remain as is, but the average future growth to be below 4% per year, or;

The company will grow above 4% per year, but its profitability will decline.

Based on the analysis above, I don’t see data that supports any of the two scenarios above.

I hope you enjoyed this post, feel free to share your thoughts.

Why match and not bumble?

Hi there, wondering if you can comment on a few things:

1. Sales to capital ratio - how did you arrive at 4.0x? Looking at 2023CY (I'm on CapIQ) - I'm seeing more in the ~1-1.5x range. My invested capital is ~$3b (BV Equity of ~$0 (slightly negative), BV of Debt of ~$4b, and cash of ~$0.8-$1b.) and my revenue is ~$1b. Implying ~1-1.2x sales to capital.

2. Pricing mix shift - how did you think about how the mix shift in consumer spending on dating apps might change. For example, many apps today charge high fee subscription pricing. This may work for premium apps (e..g, the league, tinder elite) however by and large wouldn't the average consumer adopt a more 'freemium' / 'gamified' model? I imagine this could result in depressed revenue / user, although perhaps this is covered in your conservative revenue growth.

3. Capital structure - in light of the recent starboard activist stake / push for buybacks, how do you think about that in terms of terminal WACC estimate? I agree there would be some leveraging / hence your drop from ~9%+ to 8.75%, just interesting to get your take on that dynamic.

4. Investment catalyst - what do you think the catalyst behind this pick is? In my view it's when they can prove some type of product development that supports stable paid plan take-up (e.g., by Q1 next year). Your conversative estimates are helpful in painting a margin of safety picture, but what is your view on when Match group can show convincing growth.

For what it's worth my valuation is in a similar range (low case ~current price), upside ~$40-$45). Thanks for your thoughts!