Deep dive into PayPal

Why it is the #1 position in my portfolio

PayPal is called “dead money” because its share price today is pretty much where it was 8 years ago.

As I’m writing this, PayPal is the largest position in my portfolio. Here’s my deep dive and why I think it’s significantly undervalued.

1.0 Introduction

Back in 1998, PayPal began as Confinity, founded by Max Levchin, Peter Thiel, and Luke Nosek. Around the same time, Elon Musk founded X.com, an online banking startup. In 2000, the two companies merged and kept the name PayPal. Over time, many of the early employees and founders became some of Silicon Valley’s most influential figures, the so-called PayPal Mafia. Notable members include:

Elon Musk (Tesla, SpaceX)

Peter Thiel (Palantir, early Facebook investor)

Reid Hoffman (LinkedIn)

Max Levchin (Affirm)

David Sacks (Yammer, Craft Ventures)

Only months after its IPO, eBay acquired the company for ~$1.5 billion. Over time, it grew far beyond auctions and became a global online payment platform.

In 2015, driven activist investors and market pressure led to a spin-off, and PayPal became an independent public company again.

Dan Schulman became the CEO, and this separation allowed the company to partner with other e-commerce platforms (Amazon, Shopify, etc.) and pursue its own fintech strategy.

1.1 The “dead money” argument

I want to start here: the critics are correct if the focus is solely on share price movement, but wrong on all other metrics.

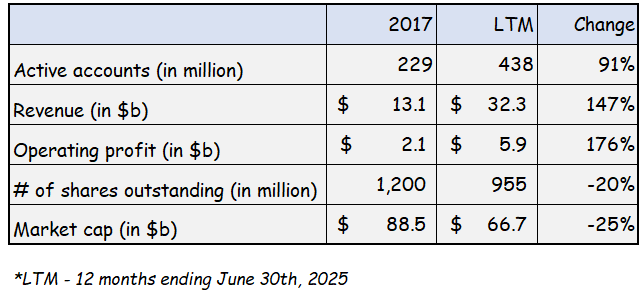

The above table outlines the following. PayPal has:

More users

Higher revenue

Higher profit

Fewer shares outstanding; and

Lower market cap.

Compared with 2017, PayPal today is significantly cheaper, and that is without even accounting for the excess cash on its balance sheet.

So, let’s focus on the fundamentals.