1.0 Introduction

In the early 1900s, Gillette started selling cheap razors, but people had to buy their special blades forever, and that’s where the profit was.

This became known as the razor-and-blades model.

Similarly, printer companies have been selling printers at low prices for decades, making their real money on the endless need for expensive ink.

Now, we have Roku, the razor-and-blades model in the streaming industry.

2.0 What is Roku?

Roku means “six” in Japanese, as it was the sixth company of the CEO, Anthony Wood. It was founded in 2002, but the first valuable product was launched in 2008 because of Netflix.

The company launched the first connected TV device to stream Netflix and continued to sell devices that plug into TVs, allowing consumers to access streaming services.

That was just the beginning.

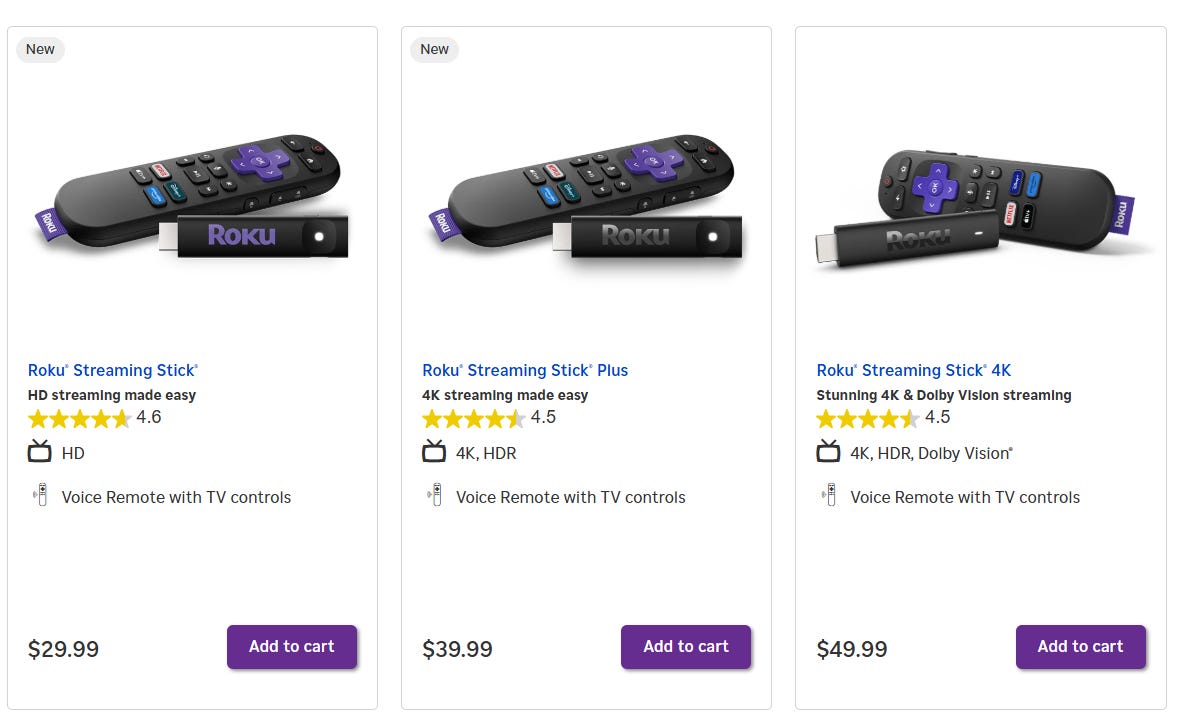

A “streaming stick” is still being sold, and the price is relatively low.

There is also a range of physical products, such as:

Roku TVs

Smart home accessories (cameras, video doorbells, lights, plugs)

Audio devices

Remote controls

Various cables, stands, and mounts.

Many products are available at popular retailers such as Amazon, Best Buy, Costco, CVS, The Home Depot, Lowe’s, Sam’s Club, Walgreens, and Walmart.

Roku's gross margin on these products is negative. So, where are the blades? Let’s look at two more topics: the Roku operating system and the platform.

2.1 The Roku operating system

Roku created an operating system that the traditional manufacturing companies could use for free!

Partnerships with companies like TCL, Hisense, Sharp, Philips, RCA, JVC, and many others are already in place.

When a TV comes with a Roku operating system, there’s no need for the streaming stick, and it comes with a Roku remote.

Selling products below the cost price and incentivising traditional manufacturing companies to use the Roku operating system allows them to attract users to the platform.

Oh, and there are a lot of users.

But then what?

2.2 The platform

In 2017, Roku launched “The Roku Channel”, a free ad-supported streaming service.

Its library includes over 80,000 movies and TV shows and over 500 live TV channels in various genres.

Unlike Netflix, Disney+, and all the other companies, there is no monthly subscription fee to remove the ads, so a premium model doesn’t exist.

The primary revenue source is advertising, and its expansion outside of North America recently started.

Apart from that, some movies can be rented, and the company takes a cut if someone subscribes to Netflix through the Roku platform.

Lastly, Roku sometimes charges streamers/platforms for distributing or prominence on the home screen.

Without manufacturing the TVs, the company is a key distribution middleman for streaming services and content producers.

Give away the operating system, monetize the audience.

But this is not where it ends. There is (and will be) a lot of innovation around ads.

Unlike traditional linear TVs, Roku has information about the viewer and can serve better ads. Imagine seeing a shippable ad for a new kitchen gadget that you can purchase through the TV. Walmart, for example, will fulfill the order.

3.0 The competition

Amazon Fire TV, Apple TV, and Google/Android TV are all competitors with much, much bigger budgets.

Yet, Roku is crushing it. Why?

Because it can afford to be content-agnostic and doesn’t need to profit from the hardware.

Roku isn’t a content company, but it dabbles. Its content comes from acquisitions or relatively low-budget productions, sometimes funded by the advertisers.

As the users move from traditional linear TVs to streaming, so will the advertisers. I believe Roku will benefit from this in the future.

4.0 The past acquisitions

As I write this, Roku's market cap is $10 billion, up 160% since the IPO in 2017 (outperforming the S&P 500) but down 85% from the pandemic hype.

Over this time, there were some acquisitions, ranging from $50 million to $200 million:

Dataxu (2019) - Providing tools for programmatic video ad buying, enabling advertisers to plan, buy, and optimize video campaigns more effectively.

Nielsen's advanced video advertising (2021) - Automatic content recognition and dynamic ad insertion technology

The Old House Ventures (2021) - A library of home improvement content, attracting audiences interested in lifestyle content

Frndly TV (2025) - A streaming TV service with access to over 50 top-rated live TV channels and thousands of hours of on-demand content (priced at $6.99/month).

All these acquisitions seem to align with what Roku is building.

5.0 Historical Financial Performance

Looking at the financial performance, a few things stand out.

First, the revenue growth has been impressive, and was fueled by the pandemic. However, recently, it has slowed down.

Second, the gross margin is relatively stable but low for an advertising company. The main reason for that is the hardware component, which contributes 15% of the revenue and has a negative 15% gross margin. The remaining 85% (platform revenue) has a gross margin of 54%.

Third, after covering all the operating expenses, Roku is not yet profitable.

This could lead to the question: Can Roku even become profitable? What does the road to profitability look like?

5.1 Road to profitability

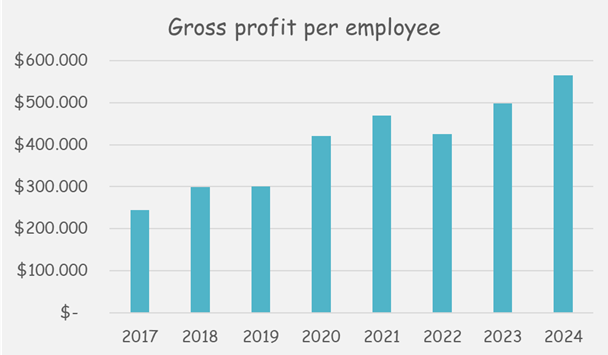

When a company grows so quickly, it must significantly increase the number of employees. There’s rarely time to rationalize and improve operations when chasing growth.

I believe the number of employees will decrease or remain stable as the company grows, reducing the expense as % of revenue.

An interesting metric to follow is the gross profit per employee.

5.2 Average revenue per user (“ARPU”)

This is normally a very important metric for user-based companies, but in this case, it can be misleading.

At first glance, it seems the company’s ARPU has reached its peak.

The truth is, international expansion will naturally push this number down as the ARPU in Latin America or Europe will be lower than the ARPU in North America. Hence, this is not a metric that should be taken at face value without considering the geographical location of the users.

5.3 The capital allocation

Although the company is not yet profitable, it has positive cash flow due to its share-based compensation. Of course, that’s not free, leading to a significant increase in the number of shares outstanding.

The number of shares outstanding is now growing by ~3% per year.

In addition, there are two classes. Each class A share has one vote per share, while each class B share has ten votes per share. This allows the CEO, Anthony Wood, to have the majority of the votes despite owning 12% of the outstanding shares.

So, what happens with all the excess cash generated, other than acquisitions?

Nothing.

The net cash position continues to grow and is at ~$1.7 billion as of Q1-2025.

It is worth noting that the company raised ~$1 billion in 2021 by issuing 2.6 million shares at $380/share. Given the pandemic hype, this was a wise decision.

6.0 Valuation

6.1 Revenue

Revenue-wise, I expect the current growth (~10%) to continue due to the following reasons:

First, the household penetration shows no signs of reaching a plateau. Given the room for international expansion, I don’t see this slowing down anytime soon.

Second, there are other verticals to add, such as gaming, that I believe will add more value and users to the platform, and further increase the ARPU.

Lastly, as mentioned earlier, as more users move from traditional linear TVs to streaming, so will the advertisers.

6.2 Operating margin

Advertising is a high-margin revenue source, and once economies of scale combined with internal cost optimization are in place, my best estimate is that the operating margin will grow to ~20%.

6.3 DCF

Based on the above assumptions, here’s the DCF model:

The company’s fair value is ~$9 billion ($62/share), slightly below the current market cap of $10 billion ($70/share).

A 15% operating margin reduces the fair value to $50/share.

A 25% operating margin increases the fair value to $76/share.

This is without discounting the valuation for lack of ownership, which I think is appropriate.

7.0 Other data to consider

7.1 Advertising is cyclical

The advertising industry is known to be cyclical, meaning that effectiveness and the amount spent can fluctuate with economic cycles. Management can do very little to prevent this.

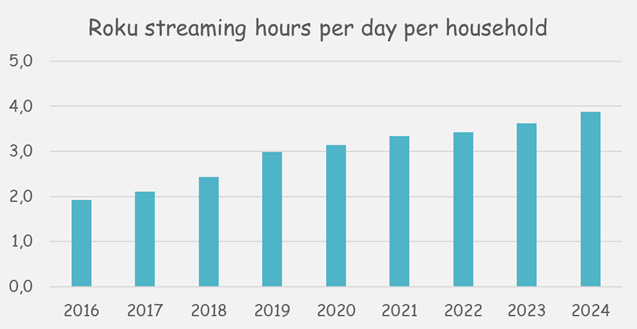

7.2 Streaming hours per day, per household

I think this chart is self-explanatory.

7.3 Potential acquisition target?

Given the nature of the business model and the valuation, I would not be surprised if Roku gets acquired. It would be an interesting fit for a telecom company.

If you found this deep dive valuable, consider sharing it with someone who would too. Your support helps grow The Finance Corner and brings more deep dives like this to your inbox.