Deep dive into Snap ($SNAP)

Meta's free R&D department

1.0 Introduction

SNAP 0.00%↑ has a market cap of $20 billion and is a great case study of a company that innovates a lot, yet captures very little value.

I’d argue that Snap is Meta’s free Research & Development department.

We’ll get to that conclusion. But, first things first.

2.0 History

Back in 2011, Reggie Brown came up with a concept where people could send photos over that would disappear after a short time. He shared this idea with his friend, Evan Spiegel, and a project for a design class was born, under the name “Picaboo”. However, to bring it to reality, they needed someone who could code, so they involved Bobby Murphy.

*Reggie Brown (left), Bobby Murphy (middle), and Evan Spiegel (right) celebrate the app’s creation.

In July 2011, Picaboo was launched, but the team received a cease-and-desist letter from a photo-book company with the same name.

So, in September 2011, the app was renamed Snapchat.

What started as a cool friendship story, didn’t last long, as Reggie Brown was pushed out of the company. After a legal battle, he won a $157.5 million cash settlement in 2014. Since then, the Snap story continues with Bobby Murphy and Evan Spiegel.

Before we dive into the company’s business operations and historical financial performance, it is worth noting its ownership structure. There are 3 classes of shares:

Class A - trading on the New York Stock Exchange, with no voting rights

Class B - common shareholders have 1 voting right per share (not publicly traded); and

Class C - common shareholders have 10 voting rights per share (not publicly traded)

Why is this important?

Because this structure allows the two gentlemen above to have 99% of the voting power. They are in charge of all decisions that impact the shareholders, including the election, removal and replacement of directors, mergers and acquisitions, capital allocation, etc.

In theory, when one is valuing a company of this kind, a discount should be applied for “lack of control”. This means, an identical company where the power is not as centralized, would be valued higher.

3.0 Its journey of innovation

The app became popular for its disappearing messages, appealing to users who were seeking a more private and ephemeral way to communicate. These messages were called “snaps” and by the end of 2012, Snapchat was processing 20 million snaps per day.

That was only the beginning. The company continued innovating and bringing new features.

Stories (2013) - Allowing users to share photos and videos that lasted 24 hours. This concept has since been adopted by other social media platforms, such as Instagram and LinkedIn.

Geofilters (2015)- Allowing users to overlay location-based filters on their snaps.

AR lenses (2015) - Offering playful effects, such as face-swapping and virtual accessories. These became another signature feature of Snapchat.

Spectacles (2016) - A camera-equipped sunglasses that allow users to capture snaps hands-free.

Snap Map (2017)- Allowing users to share their location with friends and view a real-time map of where their friends were snapping from.

Lens Studio (2017) - A desktop app that allows developers and creators to design and publish their own AR lenses.

Dynamic Ads (2018) - Aimed to enhance its advertising platform.

Snap Games (2018) - A multiplayer gaming platform, integrated into the app, allowing users to play games with friends in real-time without leaving Snapchat.

Scan feature (2018) - An AI-driven feature that scans objects, barcodes, and songs- expanded the app’s utility beyond communication.

Spotlight (2020) - A platform for short-form, user-generated videos, as an answer to TikTok. Snap incentivized creators by offering millions in daily payouts for top content.

AR shopping (2020) - Enabling users to virtually try on clothes, accessories, and makeup through partnerships with major brands.

Public profiles for businesses (2021) - Allowing brands to showcase their content, AR lenses, and products directly on Snapchat.

A creator marketplace (2021) - Allowing brands to connect with influencers and AR for paid collaborations.

Dual camera (2022) - This feature allowed users to record from both the front and rear cameras simultaneously, creating a new trend.

Director mode (2022) - Aimed at creators, this feature offered advanced video editing tools directly within Snapchat, to compete with TikTok’s creator-friendly ecosystem.

My AI (2023) - A ChatGPT-powered AI, allows users to interact with a personalized AI chatbot for recommendations, assistance, or entertainment.

AR Enterprise Services (2023) - A business-facing AR solution helping brands implement AR tools, such as virtual try-ons and immersive experiences, into their own apps and websites.

All of this led to a significant increase in daily active users (“DAUs“) over time to 443 million in Q3-2024 and over 750 million monthly active users (“MAUs“).

Over 70% of those who download the app, engage with augmented reality “AR” on day 1.

So how does the company make money?

4.0 The business model

Advertising, advertising, advertising.

Yes, as with every other social media platform, advertising plays a huge role. In this case, it accounts for 96% of its total revenue.

Other than spectacles (mentioned above), the company attempted to diversify its revenue by introducing a monthly subscription Snapchat+ that gives access to exclusive, experimental, and pre-release features. It was launched in 2022, and it has over 12 million subscribers.

Here’s where it gets interesting:

~90% of the 13-24-year-old population and ~75% of the 13-34-year-old population use Snapchat in more than 25 countries.

This sounds impressive.

The problem is, that the majority of these users do not have as much income to spend compared to those who are 35 years old and above. Therefore, companies prefer advertising on platforms where they can reach an audience that can afford to purchase their products, and Snap isn’t as appealing.

The best way to illustrate it is through the two key indicators below.

5.0 Key indicators

The two key indicators that one should keep track of are:

Daily active users (“DAUs“), and

Average revenue per user (“ARPU“)

5.1 DAUs

At first glance, it doesn’t look too bad, the total DAUs number is growing.

However, if you take a look at its composition, you’ll notice that almost all of the growth comes from the rest of the world. In the last 5 years, the total number more than doubled, but:

North America DAUs increased by 19%.

Europe DAUs increased by 52%.

Why is this relevant? Because of the second KPI.

5.2 ARPU

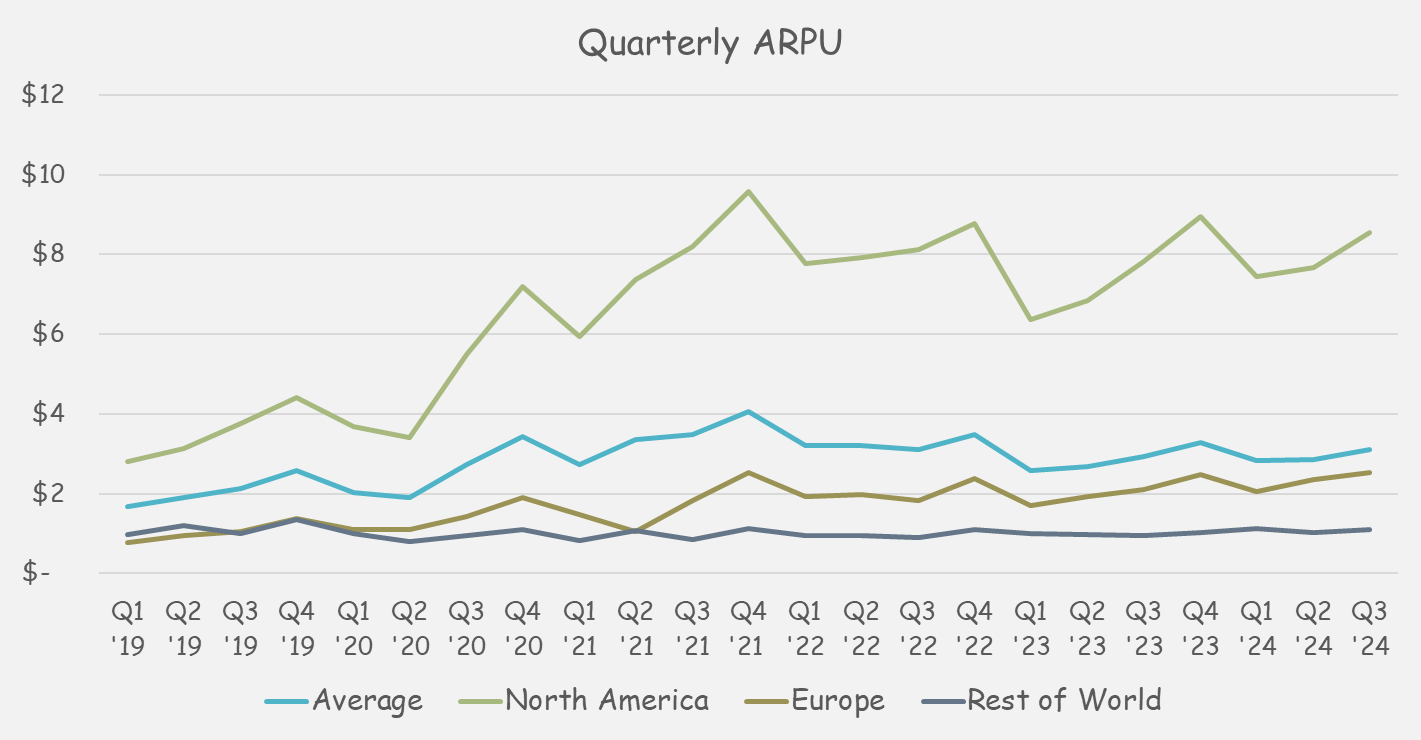

Snap reports its quarterly average revenue per user (“ARPU”).

There are a few highlights:

There’s seasonality, with Q4 revenue being the highest.

The ARPU in the individual areas hasn’t been growing since 2021.

The average ARPU has been decreasing, as user growth comes from low ARPU areas.

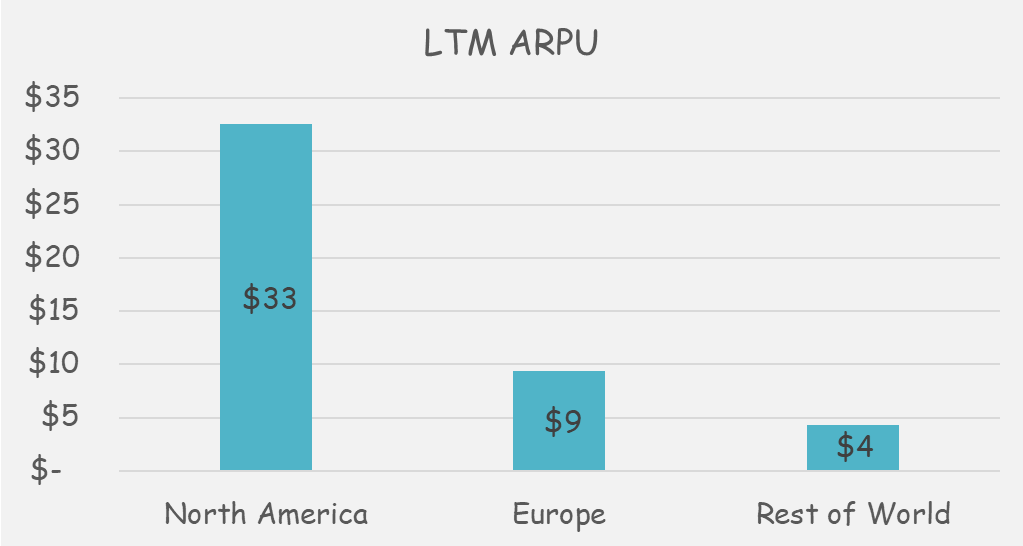

I’ve added the ARPU of the last 4 quarters (Q4-2023 to Q3-2024).

A user located in North America is worth significantly more than a user located anywhere else.

Now let’s bring back the first KPI in the discussion:

The most valuable areas (North America and Europe) aren’t growing in terms of users, and the ARPU isn’t growing there either.

6.0 The elephant in the room

Which begs the question - How can the company grow its revenue? Or, equally important, why is the ARPU so low?

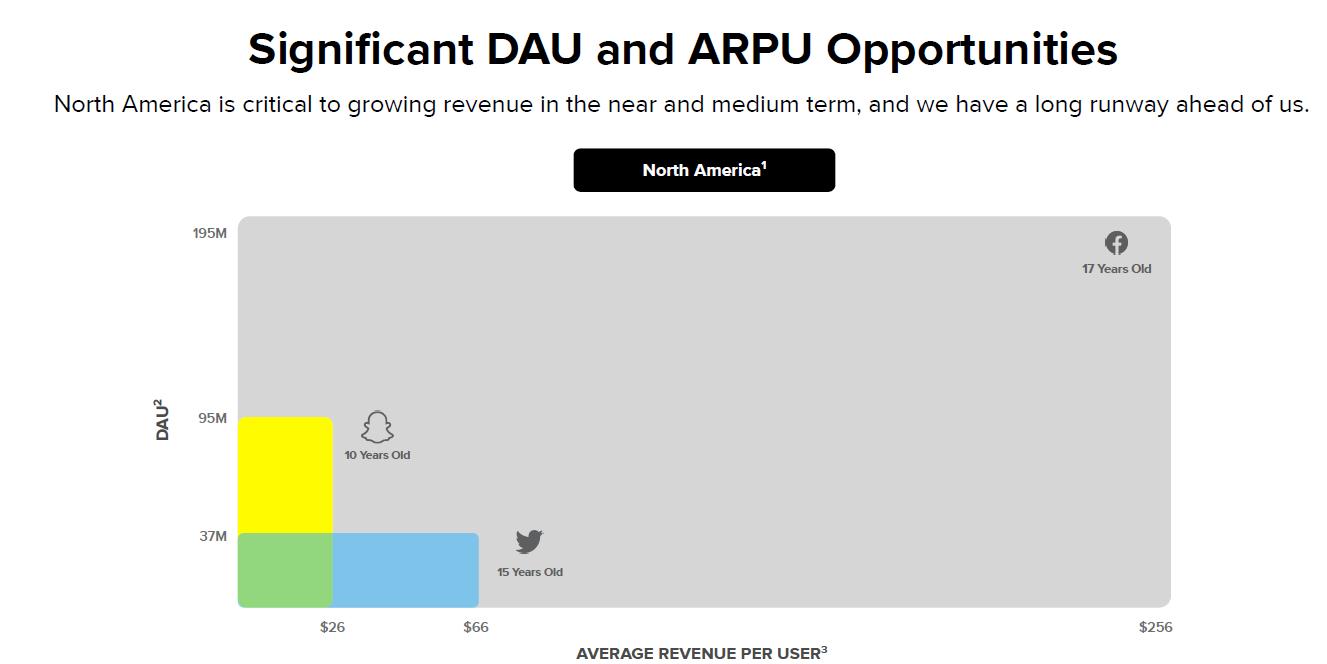

The image above is one of the slides in the October 2021 investor presentation. It compared the company’s penetration in terms of users (y-axis) and its average revenue per user (x-axis).

The management does a good job at storytelling. The “opportunity” has been there for a while. Three years later, not much has changed. Despite introducing lots of new features, the number of users isn’t growing, and the monetization doesn’t show significant improvements. So, why is that?

Snapchat is used more for direct and private communication, instead of public communication. This leads to a limited number of interactions, which in turn leads to a limited number of ads that could be shown.

A low number of ads = low monetization

If you add the fact that the users are fairly young with limited spending ability, the platform as such isn’t as appealing compared to its competitors (Instagram/Facebook, TikTok).

All of the innovation that comes from the company, is being replicated by its closest competitors that have more valuable users. Meta gets to capitalize on Snap’s R&D efforts the most. Therefore, Snap has no sustainable competitive advantage.

7.0 Historical Financial Performance

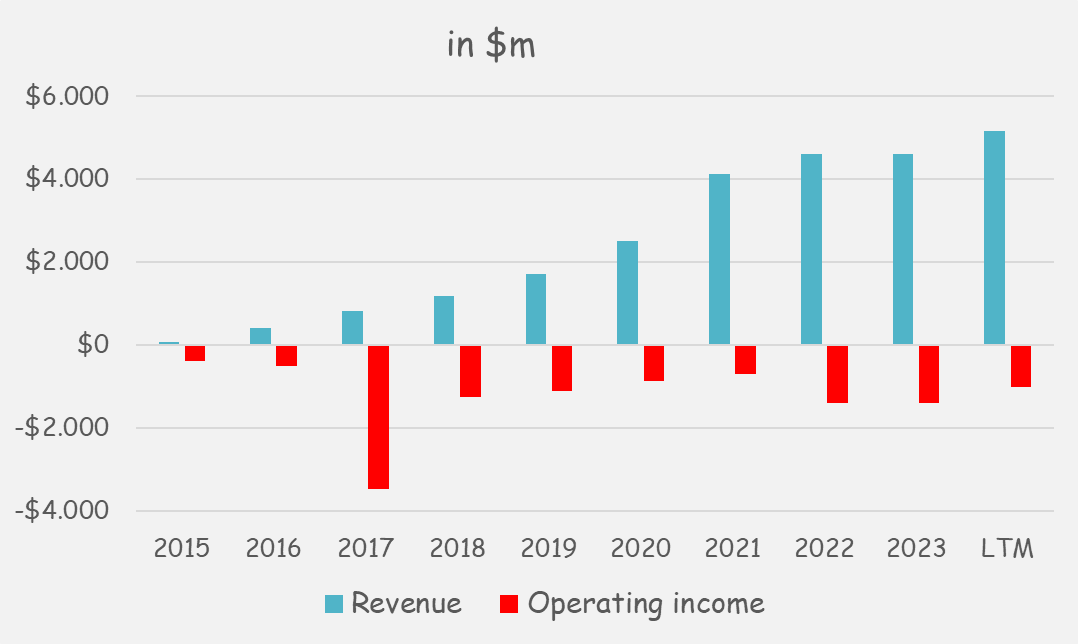

Don’t get me wrong, the revenue growth is exceptional. To grow from $59 million in 2015, to almost $5.2 billion is outstanding.

However, the company is still struggling to become profitable. With the rise of AI, Snap had to invest a lot to be in the game. Although this is helping the company to retain its users, it is impacting its margins. Its operating margin currently stands at a negative 20%.

Restructuring took place, reducing 10% of the global headcount in Q1 and Q2-2024 and there’s still a long way to go.

With all these losses adding up, you might wonder how the company is still around and not bankrupt. The answer is stock-based compensation (“SBC).

Part of the compensation of employees is in the form of shares/options. Of course, this isn’t free. It has a significant impact on the number of shares outstanding and it dilutes the existing shareholders.

Oh, and this is after using over $1.5 billion to repurchase their own shares.

Now, some would argue that they shouldn’t do this, they’re diluting the shareholders!

Let’s for a moment say that this is the right decision. What does that mean for the employees?

Instead of getting shares or options, they’d demand to be compensated with cash instead. So the cumulative SBC of ~$9 billion would’ve been actual cash outflow and it would’ve put the company at risk of bankruptcy. They’d have to raise cash via equity (incurring fees) or obtain a loan (likely at high rates, given the company is unprofitable).

So SBC for a money-losing company is a great way to reduce its bankruptcy risk.

What I’m more worried about are the insider transactions. Based on OpenInsider, insiders have cashed out over $3.1 billion since 2017 when the company became a public one.

Over 90% of these sales have occurred up until (and including) 2021. Since then, the insider sales have significantly decreased. However, there have not been any purchases.

8.0 Valuation

As with any other company, the value of Snap is determined by its future cash flows. However, its revenue and profitability growth depend on many factors, the key ones being:

Its ability to continue its expansion (all over the world);

Its ability to innovate, and extract value from new features;

Its ability to retain the existing users and capture value as they enter the workforce and have higher income, (leading to higher ARPU?);

Its ability to reduce costs; and

The macroeconomic conditions (advertising spending is under pressure during a market downturn)

There is no doubt that Snap has the attention of a huge audience and there’s potential. The potential has always been there.

I do expect the revenue to continue growing primarily driven by:

Increase in daily active users outside of the United States and Europe; and

Increase in average revenue per user as the youngsters become a larger part of the workforce.

I do expect the profitability to improve over time driven by:

Workforce reduction (already started in Q1-2024); and

Economies of scale - A part of the direct costs are AI-related, they will decrease as % of revenue over time.

Lastly, I apply a 15% discount due to lack of control. Based on my analysis,

Below is my DCF model:

Based on my input, the fair value of the company is ~$18.5 billion (~$11/share), slightly below today’s share price of $12.

8.1 The Bull Case

Here’s what a bull case would look like:

Continued innovation in AR and new features driving user engagement;

Improved advertising capabilities and Gen Z becoming a dominant force in the workplace leading to significantly higher ARPU;

Continued expansion into emerging markets and increased global penetration;

Potential to be acquired (Microsoft, Amazon, Disney, Shopify).

In this case, the fair value today would be above $15/share.

8.2 The Bear Case

On the other side, here’s what a bear case would look like:

All new features are being mimicked by the closest competitors and Snap doesn’t capture any value (again);

Persistent competition eroding market share;

Failure to attract older demographics;

Challenges in monetizing effectively, especially with macroeconomic headwinds;

Inability to diversify revenue streams beyond advertising

In this case, the fair value today would be below $5/share.

If you enjoyed this post, consider sharing it, it helps the newsletter immensely.

Very insightful! You bring up a good point with Snap creating very innovative new features, but Meta smartly mimicking anything Snap does.

One question - if TikTok were to be banned in the US, do you believe this would help Snap's bull case since TikTok's demographic skews to a younger audience? Or do you think Meta will take the lion's share of TikTok's US users and squeeze out Snap from the market in the process?