1.0 Introduction

The best way to describe Warner Bros. Discovery is - a puzzle. A puzzle with more pieces than one needs, and a puzzle where the pieces keep moving.

To truly understand its value, I’ll be making some accounting adjustments. Yes, I know, fun!

Let’s get started.

2.0 The merger

Warner Bros. Discovery is the outcome of a merger between WarnerMedia (a spin-off by AT&T) and Discovery that happened not that long ago (April 8, 2022).

Although it is labeled as a merger, accounting-wise, Discovery absorbed (acquired) WarnerMedia. AT&T received a total compensation of ~$40.4 billion.

Most of the cash was raised through a bond offering to finance the cash portion of the deal. So, the newly merged company has blurry accounting and A LOT of debt. But before we dive into them, let’s understand the company's underlying business.

3.0 The Business

Warner Bros. Discovery (“WBD“) is a giant within the global media and entertainment industry, and there are many ways to slice its business. It can be done:

Geographically (U.S. vs. International);

Based on the source of revenue (Studios, Networks, DTC) or;

Based on the nature of the revenue (Advertising, Distribution, Content).

Historically, it has focused on linear TV, the traditional television medium with content delivered via satellite or cable. It owns renowned networks, such as CNN, TNT, TBS, Discovery Channel, Food Network, Eurosport, and many others, available in over 220 countries and 50 languages.

The company has franchises like Batman and Harry Potter, and its recent hits include Barbie ($1.45 billion box office) and Dune: Part Two, as well as TV series such as The Penguin, The White Lotus, and Succession.

It also comes with Warner Bros. Games, with games such as Hogwarts Legacy.

However, as more content is consumed over the Internet, a large part of the business has undoubtedly been disrupted over the last two decades. This is where its HBO Max and Discovery+ streaming portfolio comes into play.

At the end of 2024, there was an announcement, that the company would reorganize into two divisions:

Global Linear Networks - The old-school linear television business.

Streaming & Studios - Globally scaled streaming platform and the film and entertainment studios with a portfolio of the most beloved intellectual property.

The second part is most valuable, and it wouldn’t be surprising if the global linear networks segment were sold soon.

If there’s anything that Netflix taught us, it is that at scale, with great content, streaming is profitable and comes with pricing power.

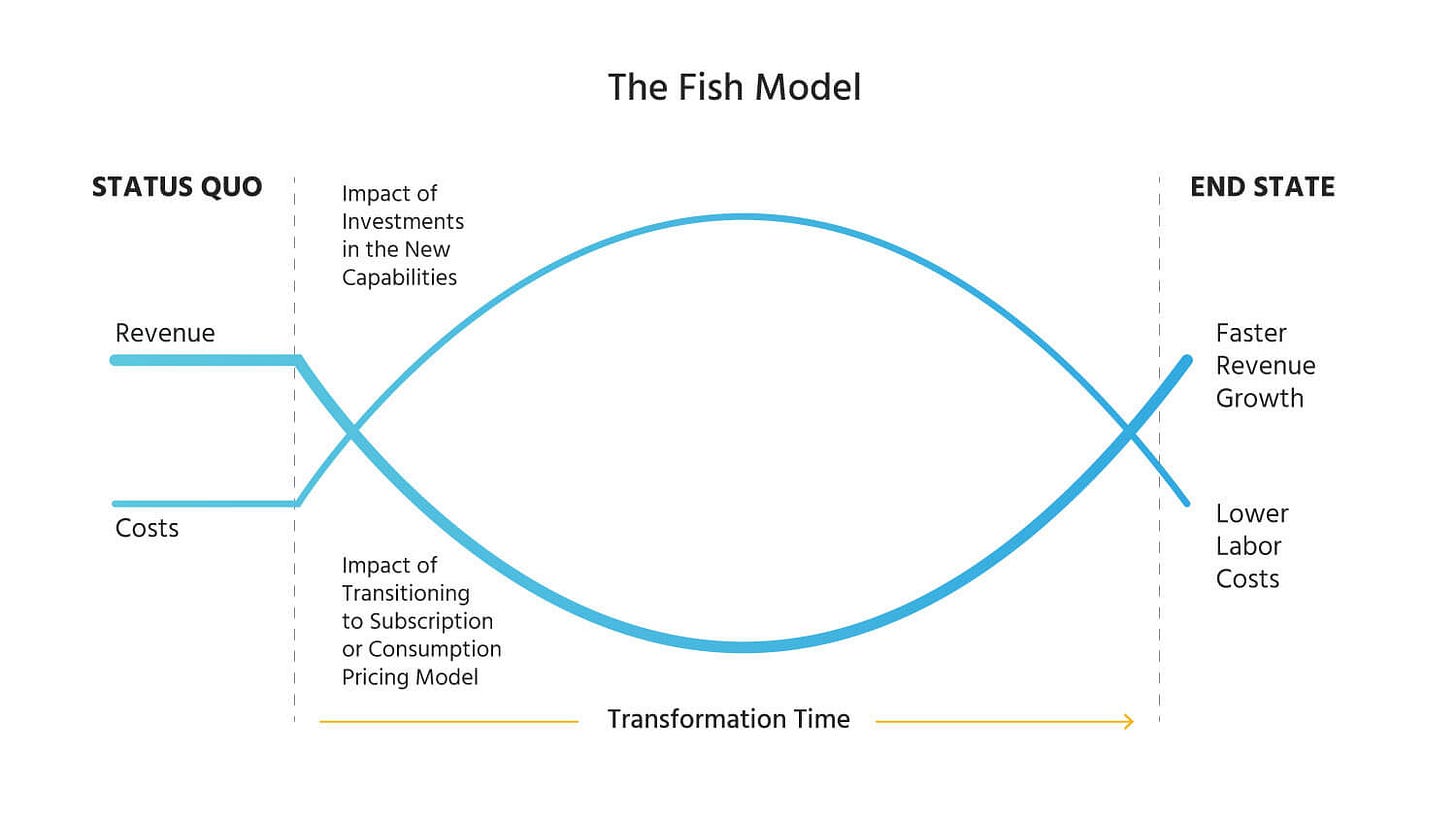

The transition to streaming isn’t easy. For it to happen, WBD needs to swallow the fish.

Many C-level executives don’t like to do this. It involves substantial risk, significant investments, and (hopefully) temporarily lower profits.

But not going through a transition of this kind is equally risky.

The merger accelerated the company and made the streaming offering far more compelling. In Q3-2024, there were over 110 million DTC subscribers, which is one-third of Netflix's total.

I do not see the streaming market as a winner-takes-all, but as one that will allow for many big winners (Netflix, Amazon Prime, Disney+, Tencent, iQIYI, HBO Max, Paramount+, Hulu, etc.).

Of course, you are feel to disagree with me.

4.0 The Blurry Accounting

The accounting of M&A is always interesting. The total consideration is allocated across identifiable assets and liabilities (tangible & intangible), and what’s left is goodwill.

I want to highlight the ~$45 billion intangible assets.

These assets are the result of WarnerMedia's business activities over the years. They’ve developed trademarks and valuable relationships with their subscribers. In this transaction, a dollar amount is being allocated to them.

This means that the $45 billion will be amortized over time.

However, unlike tangible assets (or content), the company doesn’t need to reinvest to replace them.

This means, looking at the P&L as is, over time, there will be $45 billion of amortization that the company pre-paid for (by acquiring WarnerMedia).

If we agree that a company’s value depends on its future cash flows, the impact of amortization should be ignored.

Does it mean you should subtract all amortization? NO. A distinction needs to be made between the amortization of intangible assets that do not require reinvestments (such as customer relationships and customer lists) and ones that require reinvestment (such a software, licenses and content)

Luckily, a table with amortization per year is provided as part of the annual report when acquisitions occur.

Below is that table for Warner Bros. Discovery (in $m).

So, using a ratio (such as P/E) without adjusting for the acquisition-related intangibles is a terrible idea.

Here’s the impact:

The operating margin in the last twelve months (ending Q3-2024) was -2%, which leads to the conclusion that the company is unprofitable. However, once the adjustment is in, the operating margin will be 13%!

I’d love to look back years to see how revenue and profitability developed. Unfortunately, we don’t have that luxury, as the company exists only as of 2022.

We know that the company generates ~$5 billion in free cash flow per year, or around $4.5 billion if we consider share-based compensation.

5.0 The debt

But before we move there, let’s address the elephant in the room. The debt.

Since the merger was completed, all the excess cash flow has gone to repaying the debt. Over the last two years, the net debt has been down by roughly 30%.

As the company is swallowing the fish, its free cash flow has slightly reduced, and it will take roughly 8 years to repay its debt fully. Of course, full repayment isn’t the goal here, but getting it to a more manageable level. This would take at least four more years.

Investors are scared by this.

Especially if you compare the net debt of almost $40 billion with its market cap of $27 billion. Interest rate fluctuations are a big risk as they could significantly impact its pro’s profitability. The outstanding debt has an average duration of 13.5 years and an average cost of 4.7%. However, the effective interest rate will change if it needs to be refinanced.

To repay the debt faster, the company needs to grow its revenue (and profit) by acquiring more subscribers. However, to do this, it needs to invest in content and marketing.

To repay debt, or invest in content & marketing - That is the question now.

Based on the management’s decisions, it seems they are balancing the two.

David Zaslav is the CEO of WBD. He was the CEO of Discovery since 2006, and played a pivotal role in Discovery, including the merger with WarnerMedia.

He is known for his aggressive, forward-looking approach.

Although he is celebrated for his vision, he has been criticized for canceling projects and laying off employees.

Given the debt position of the company, these decisions are understandable.

He’s currently 65 years old. This is one of his last dances.

6.0 The strikes

In 2023, Hollywood faced two significant strikes:

WGA (Writers Guild of America)

SAG-AFTRA (Screen Actors Guild-American Federation of Television and Radio Artists)

These strikes arose from long-standing disputes over fair compensation, residuals in the streaming era, and modern safeguards - such as protection against unauthorized digital reproductions.

For WBD, these events had a profound impact. The simultaneous halt of both writing and acting work has stalled production schedules, disrupted release plans, and threatened the steady pipeline of new content crucial to their multi-platform strategy.

7.0 Valuation

In hindsight, the $40 billion payment to AT&T for WarnerMedia was too high. The company recorded a $9 billion impairment of goodwill in 2024.

Although analyzing the merger is an interesting case, it is not useful for valuing WBD today.

Anyone involved in an M&A deal knows that change takes time. This is even more true in the movie industry, where a movie takes years to create.

If you add the strikes on top of that and the room to grow the number of subscribers, I’d argue that the WBD of tomorrow will be more profitable than the WBD of today.

Below is my DCF model:

Based on my assumptions, WBD is worth ~$35 billion ($14/share), slightly more than its current market cap of share price of $27 billion ($11/share).

The discrepancy is a perfect reflection of the investor’s sentiment. It will change only when (and if) the debt is significantly lower.

7.1 The Bull Case

Here’s what a bull case would look like:

Continuous growth in subscribers that leads to higher revenue and translates into higher profit;

Capitalizing on its deep IP portfolio (DC Comics, Harry Potter, and HBO originals);

Stabilizing ad revenue from its Linear TV segment (currently declining);

Accelerated debt reduction below 2.5x EBITDA;

Spin-off of certain linear TV networks;

Successful new content & games;

Interest rates decrease, and refinancing occurs at favorable rates.

In this case, the fair value would be closer to $20/share.

7.2 The Bear Case

On the other side, here’s what a bear case would look like:

Subscribers growth slows, and the DTC segment fails to improve its profitability;

Flop of new releases (Film, TV, games);

The linear TV segment continues to decline, bringing even less ad revenue;

Low debt repayment rate;

Its credit rating is downgraded, interest rates go up, and the debt refinance comes at a higher rate;

In this case, the fair value would be below $3/share.

As you can see, there are so many moving pieces and so many variables that could go either way. Betting on WBD means betting on the management’s ability to navigate this successfully.

If you found this deep dive valuable, consider sharing it with someone who would too. Your support helps grow The Finance Corner and brings more deep dives like this to your inbox.

I hope you are right. They certainly have a lot of content. I know Longleaf was very bullish at one time, but I think they have tempered their enthusiasm. You may want to go a see what they have written. They also did a podcast with the CEO, but that’s probably aged by now, but maybe still worth a listen. Personally, I don’t watch much on Max. But the Harry Potter and DC comic properties may interest someone. Discovery was always known for their low cost budget documentaries and can’t recall if they maintained some of the European sports channels they acquired back in the day. Nice write-up.

Nice write up! I too have been trying to value WBD. You did a great job explaining the future depreciation part. Just curious why you think revenue will be up +4% YoY for the next few years. For 2024, sales will probably be down YoY. Is the company planning/doing anything that makes you think sales will inflect higher this year?