I’m sure you’ve seen plenty of comments online that the Share-based compensation (“SBC“) for a certain company is “too high”, the shareholders are being diluted, and therefore, it needs to be reduced.

Comments like this imply that reducing it is not only easy but also beneficial for the existing shareholders.

This is not true, and let me elaborate:

SBC is a powerful tool in the corporate world but is often misunderstood by retail investors. Despite its bad reputation for diluting shareholders, it plays a big role in aligning the interests of the shareholders and the employees.

Here’s a very simple example:

Imagine you have a business idea and need a website for it. Your friend Mike is a web development legend, but, you are a bit short on cash.

For that reason, instead of paying him in cash, you offer him a stake in your new venture. This is a classic example of SBC: you've diluted your ownership but avoided cash outflows, and you’ve aligned Mike's interest with yours. So, the risk and reward is now shared by both of you. You are on the same team. This also means Mike will evaluate the chances for its success before accepting your offer.

In public companies, it is common that part of the compensation of the most valuable employees and the top management is in the form of shares or options. Similarly to the previous example, this aligns their interest with the interest of the shareholders, it reduces the cash outflow, and, as you’ll see later, helps reduce employee turnover.

So, how can SBC be reduced? The only way to reduce the dilution is to compensate the employees (or Mike) in cash.

For unprofitable companies, this means they will be losing even more cash and might need to raise additional capital, which leads to dilution anyway. Not only that but:

There are more legal and transactional costs incurred along the way.

The employees have no ownership in the company and might be less invested in its success.

Reducing SBC isn’t free, and for unprofitable companies, it is often just a bad idea.

The concept of share-based compensation isn't new. It emerged as a way for early-stage unprofitable companies, especially in technology and startups, to attract talent when they couldn't afford high salaries. Over the years, it has evolved into a standard practice in many industries, seen as a way to align employees' interests with those of shareholders.

While SBC is valuable and aligns interests when used appropriately, it can also be destructive to existing shareholders. It might lead to short-termism if performance goals favor immediate results over long-term sustainability. This could result in underinvestment, cost-cutting, and even taking risky decisions and accounting fraud.

In addition, the market volatility could impact morale, as shares and options are less reliable than cash. Take a look at Zoom:

The market was irrational during the pandemic, pushing the share price to unreasonable levels. If you are an employee in the company and were given stock options, to buy shares of Zoom at $300, $400, or maybe even $500 per share, well, there’s not much value there given the share price today.

The opposite extreme movement in the share price also brings a challenge.

Take a look at Nvidia:

Its share price skyrocketed over the last 5 years, and now many employees find themselves with options or shares worth millions of dollars. Although this is great for them and many will choose to retire early, it brings a new challenge to the management, which is - How to retain this pool of talent, how to keep it motivated, or, worst case scenario, how to replace it.

Let’s go over the 4 most common types of SBC:

Restricted Stock Units (“RSUs“) - This type of compensation grants employees shares that vest over a certain period. For instance, you might receive 100 shares if you stay with the company in the next 3 years. This period of 3 years is called “vesting period”, and it not only incentivizes retention but also ensures that you do your best and add value to the company, as you directly benefit from it. You might say, well, this is just 3 years, so there’s no incentive to stay after that. Why wouldn’t I sell the shares after 3 years and leave? Plans of this kind start every year, so there are always shares that are vesting, creating a continuous incentive to stay.

Stock Options - This gives the employees an option to purchase a share at a predetermined price. This predetermined price is known as the “exercise price”. For example, as I’m typing this, the share price of Meta is around $500. Imagine that today, you are given the option to buy a share of Meta for $500. You might ask, well, wait a second, that is the market price. I don’t need this option, I have this option already. But the market price will change tomorrow, and the day after that, and the day after that. The exercise price of your option remains the same. The higher the share price, the more valuable this option is. So, if the share price goes up to $800, you can still buy a share for $500. Same as the previous example, if you leave the company, the option is no longer available. However, the stock options have an expiration date and do not last forever.

Employee Stock Purchase Plans - These plans allow the employees to buy shares at a discount, typically ranging between 5% and 15%. However, the shares must be held for a certain period of time before the employee can sell them. This timeframe can range from 6 months up to a few years.

Performance shares - As the name suggests, these are only granted, if certain performance goals are met. These types of shares are more common for executives and managers, and the metrics are often times financial, such as EPS, or Return on capital employed, or in some cases, the market cap of the company.

At the end of the day, SBC is a tool that the management has. It can be used to create value for the existing shareholders, or it can be used in a way that destroys value. Understanding it is crucial for both companies and investors to navigate its complexities.

While it doesn't involve cash outflows, it does have an associated cost. The two key factors in determining this expense that is recognized on the income statement, are:

The fair value of the compensation and;

The timing

The fair value is typically determined on the grant date and remains unchanged regardless of subsequent share price movements. For companies with high share price volatility, the recognized expense may not accurately reflect the true dilution. The annual reports of the public companies include a note on share-based compensation, providing inputs to calculate fair value.

Once the fair value is determined, it is typically expensed over the vesting period. For example, if the vesting period is three years, one-third of the fair value is recognized as an expense each year. Accounting rules allow companies to estimate what % of the employees will leave the company throughout this period and include this input when calculating the expense.

There is one metric that we need to bring into this conversation, that is heavily impacted by SBC and that is free cash flow. This formula is very simple:

Since SBC is not a cash outflow, it isn’t included in the formula. So, if someone uses FCF as a metric for profitability, it will be overstated as the dilution isn’t taken into account.

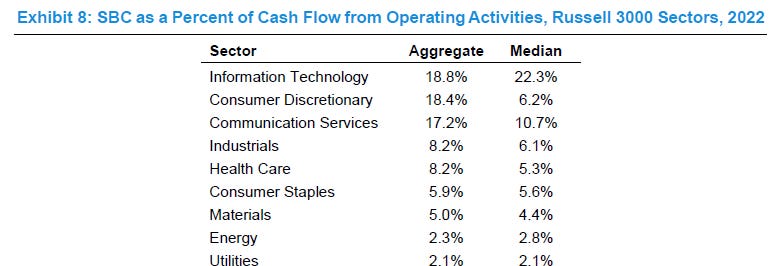

Morgan Stanley shared research, that for the Russell 3000 index, which represents the 3,000 largest public-held companies incorporated in the U.S., SBC ranged between 2% of the operating cash flow for companies in the utility sector, up to over 20% for companies in the I.T. sector.

If you are analyzing and valuing a company it is quite clear that you cannot just ignore this. You have two options:

Include the impact of SBC in your model and treat it as a cash expense, or;

Ignore it, as it has no cash impact, but ensure the dilution is reflected in the # of shares outstanding.

I hope you enjoyed this post, feel free to share your thoughts.

This was super valuable! Thanks for the great content! Great Saturday morning read!

Very much agree - the only thing I would add is that part of what makes SBC successful is not just the way it is deployed but the culture of the business.