1.0 Introduction

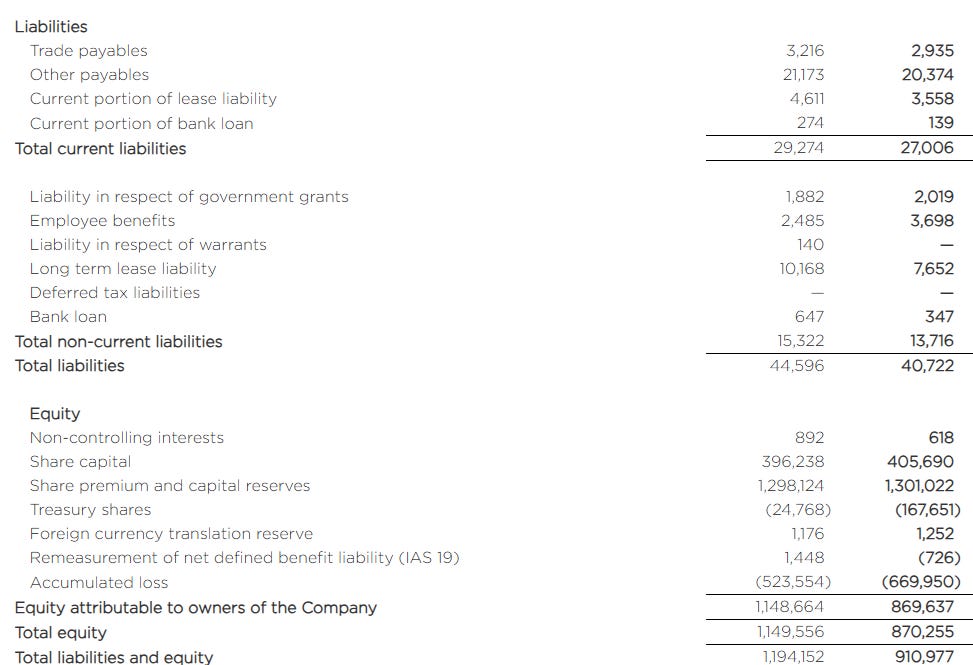

Let me ask you a simple question, how much would you be willing to pay for this company, if all you had was its balance sheet?

Take your time. Don’t rush.

You are probably wondering, what is the catch?

This seems fairly simple. Over 90% of all the assets are cash, bank deposits, or investments in securities, and there’s very little debt. So, it would not be surprising if you got to a valuation close to the company's equity.

What if I told you that the market cap of this company is $470m?

Now, you are really wondering, what is the catch?

2.0 The actual introduction

The company in question is Nano Dimension NNDM 0.00%↑ and to understand the full picture, I have to walk you through the story.

2.1 The problem

Every company that sells products and innovates, is building prototypes of new products to assess the quality. Those companies that completely outsource the manufacturing (especially offshore, to save costs) likely outsource this too. What that means is, for every new product:

Specifications are provided to the offshore manufacturing company.

A small batch is manufactured (as it is a prototype), which means it is more expensive

The prototype is delivered (which takes time).

The quality is assessed and if further improvements are needed, the process is repeated.

If there are a few iterations of this, it not only costs money, but it costs time.

Imagine, if the same company could do this in-house, and cheaper?

That’s where Nano Dimension comes in.

2.2 The solution

Over time, they’ve developed various 3D printing solutions, that tackle the above-mentioned problem. Similar to the old-school printers, they’d be making most money on the “ink”, and not the printer itself. At least, that has been the idea.

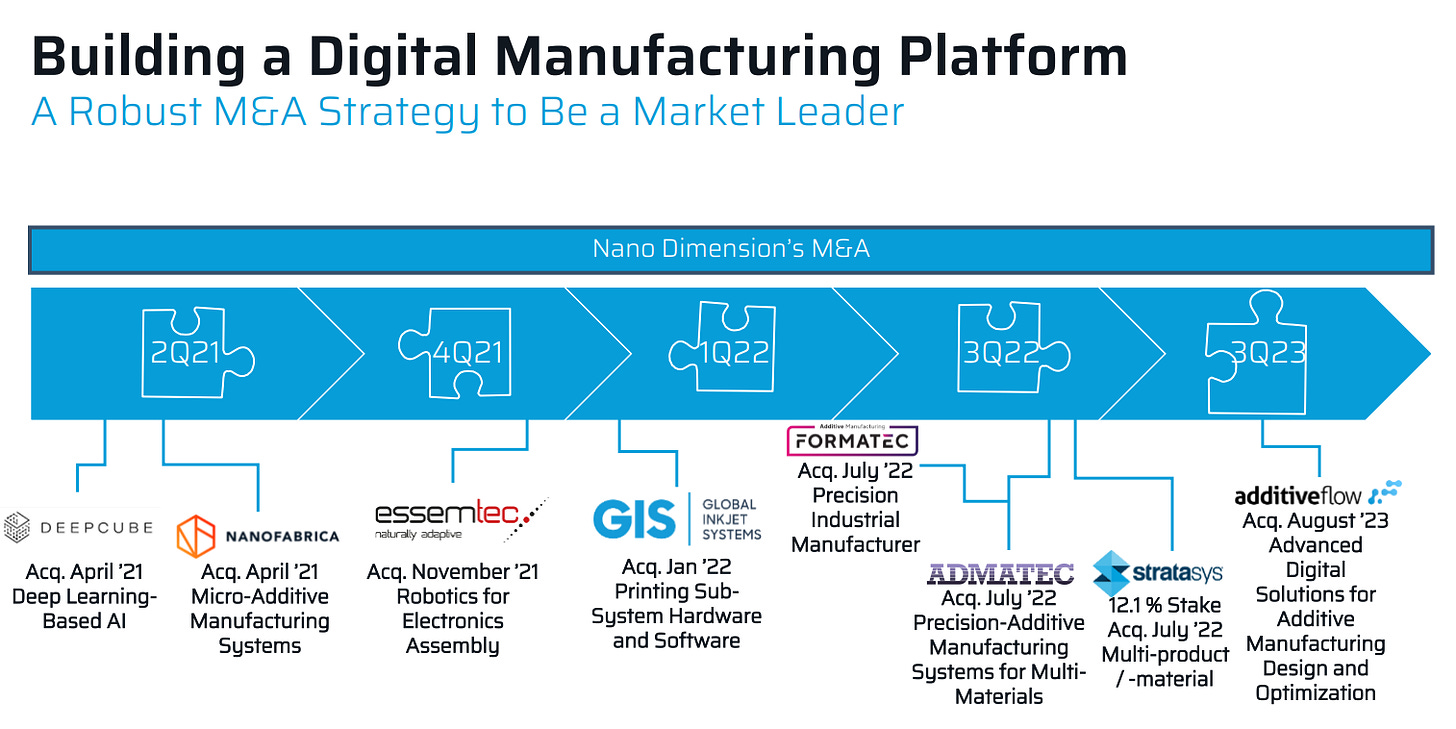

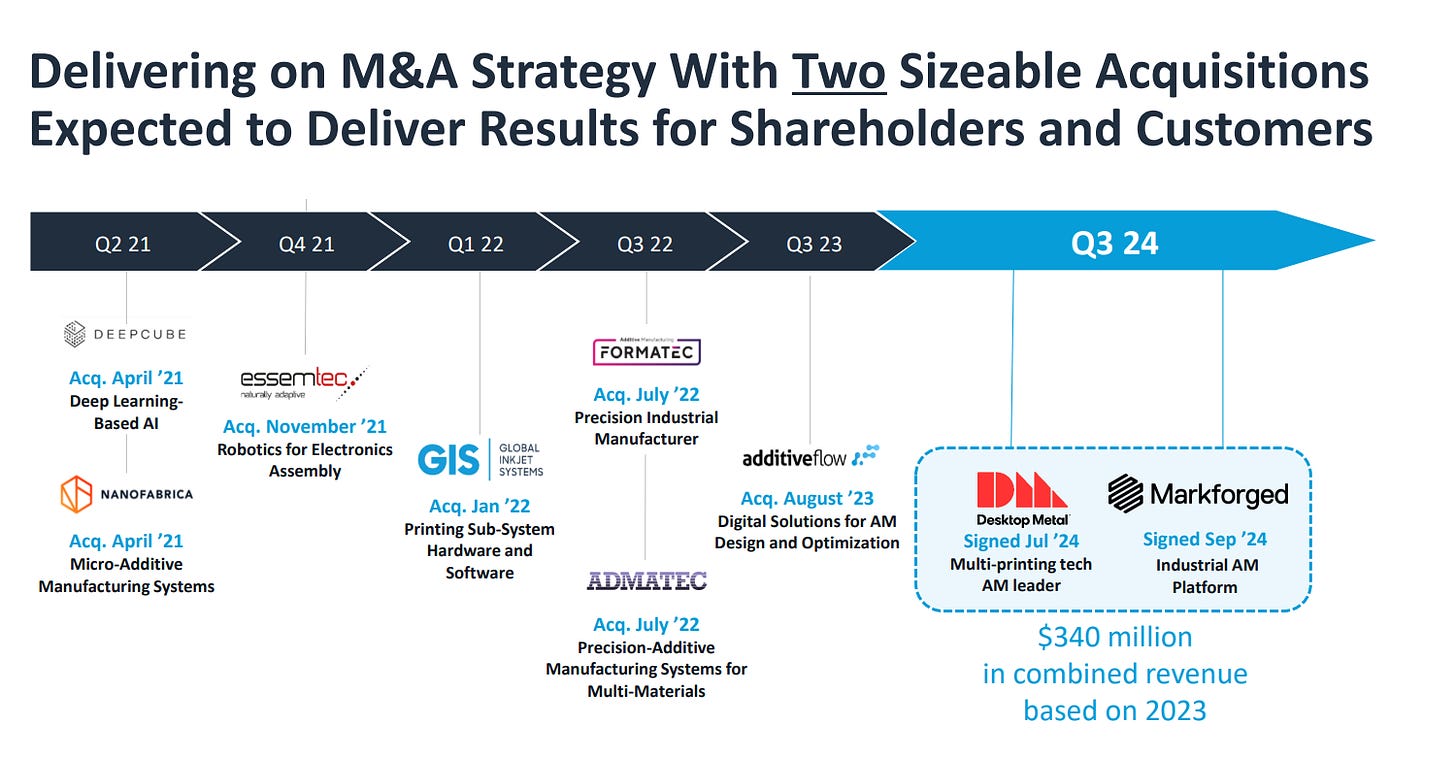

During 2020/2021, the management has raised $1.5 billion, to support further R&D activities and acquire companies that would add value. Over time, they’ve acquired quite a few.

3.0 The problem

If you read until now, it all sounds good, so it doesn’t answer the question of why is Nano Dimensions trading significantly below net cash.

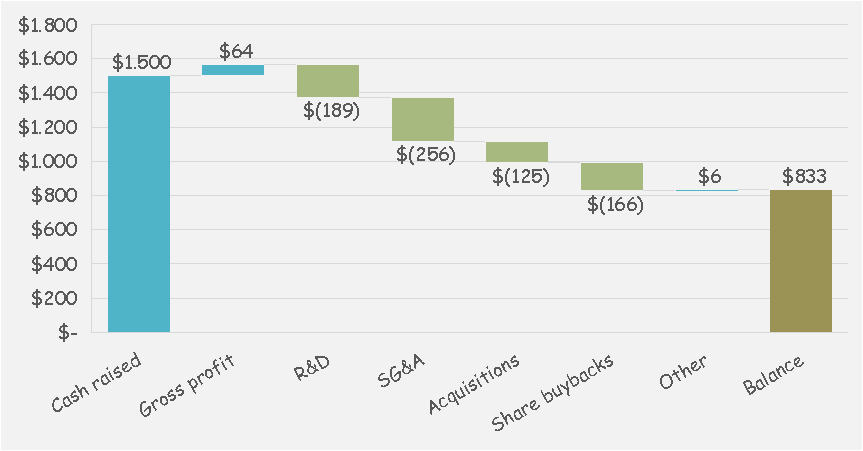

It has been roughly 3 years since the cash was raised. Let’s have a look at its allocation between 2020 and H1-2024:

*all numbers in millions

Yes, the company generated only $64 million in gross profit. Although that is somewhat concerning, the other buckets are even more concerning.

The company raised so much money, to then not allocate it for YEARS.

Not only that but over $160 million was used to buy back shares, which is an admission that they have no good use for the funds.

This trend of capital allocation is what worries investors. The market expects that the management mismanages what is left in the company, and continues to destroy value.

4.0 The future

Two interesting events recently happened that are relevant for the company’s future.

Murchinson - A significant shareholder with ~7% of the outstanding shares issued a letter to shareholders detailing the need for boardroom change. The full letter can be found here: https://www.savenanodimension.com/

I encourage you to read it, it is wonderful, and it is only 6 pages.

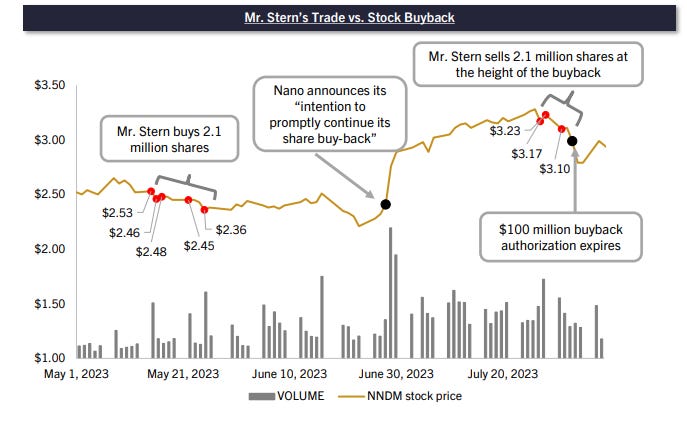

It even goes so far as accusing the CEO earned over $1.6 million by buying shares opportunistically and then selling them within 3 months, while the share repurchase program was at its peak:

Instead of addressing the challenges, the management sent a response (through a press release) with the title “Your Investment is at Risk” and here’s the link to it:

https://investors.nano-di.com/press-releases/news-details/2024/Nano-Dimension-Sends-Letter-to-Shareholders-e086e24f9/default.aspx

The goal is to paint Murchinson as the bad guy to dismantle the company and distribute its cash.

The second event is the all-cash acquisition of Desktop Metal DM 0.00%↑ that is expected to be completed in Q4-2024.

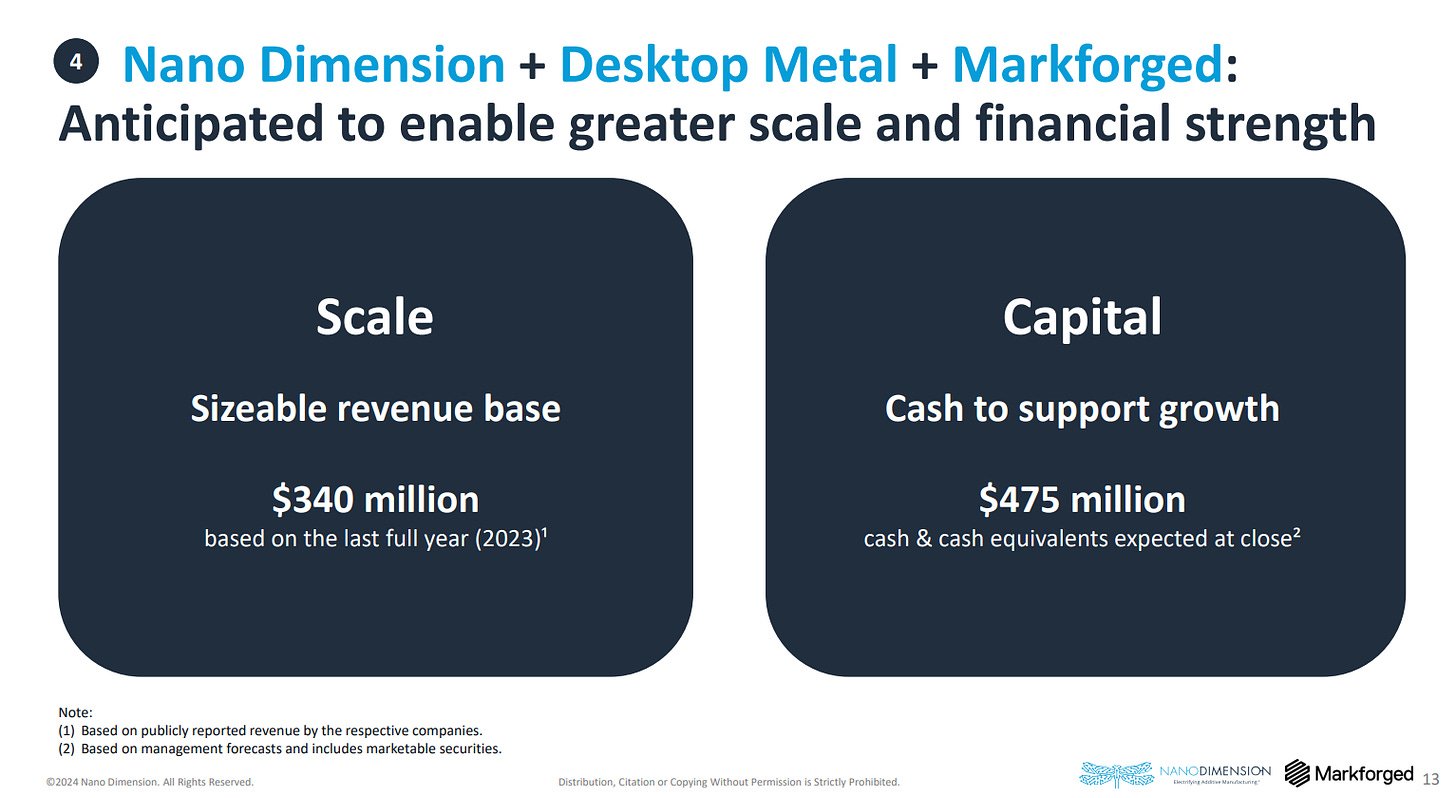

Together with Markforged, the management expects that the new Nano Dimension will be much stronger than the old one.

However, if you focus on the information provided, they focus on the positives, which are the revenue and the cash that will remain. I’d argue that it is equally important to point out the $100m+ debt that will now be part of their balance sheet, and additional operating losses. So the $475 million (that also includes marketable securities, as pointed out in the footnote), will be close to $350 after excluding debt and would be sufficient for covering losses for about 2 years.

5.0 Conclusion

It can be argued that the company (and its cash) is hostage to the current management. Storytelling from their side has been around for years, without much to show for it and the market is not buying it.

The key question is - Can the current management turn it around within a few years and at least be cash-flow neutral?

If not, it is unlikely that the market will give them another chance at raising funds and the only option would be debt financing. If that is the only option, it will likely be at an interest rate above 5%, which will make the turnaround even more difficult.

I hope you enjoyed the post, feel free to share your thoughts.