The management is expected to know the company best and provide guidance both internally and to the external stakeholders.

Many investors listen to the earnings reports, the tone of their voice, and the context, all in order to get some information about the future of the company. The analysts are asking questions regarding the future steps, to form their thesis and provide price targets.

Therefore, the chain of information is quite clear:

It starts with the management.

It gets passed to analysts and investors.

I’d like to point out an example of poor management estimates.

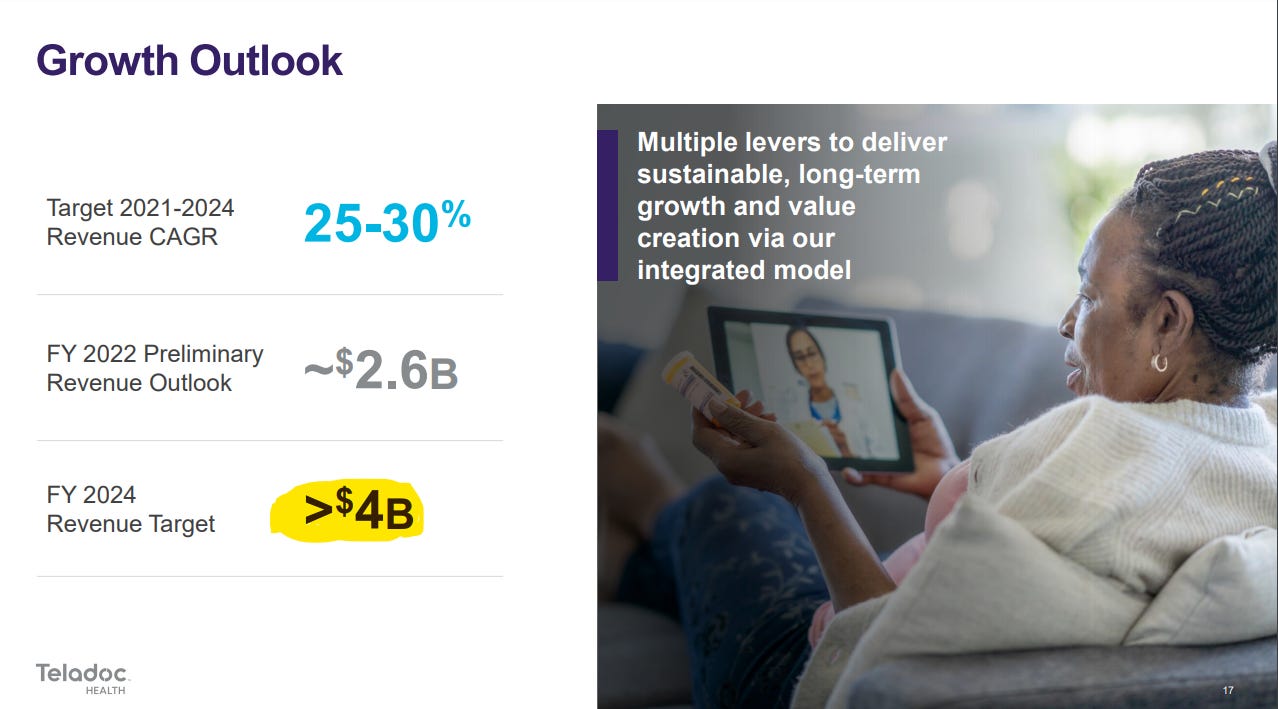

Back in January 2022, which is less than 2 years ago, the CEO of Teladoc presented the growth outlook during the J.P. Morgan HealthCare conference.

Below is the slide that focuses on the outlook:

The FY 2024 revenue target was above $4 billion.

The revenue for the last twelve months (ending September 2023) was $2.6 billion and FY 2024 revenue is expected to be around $2.8 billion.

That is quite a miss. Especially taking into account the relatively short timeframe.

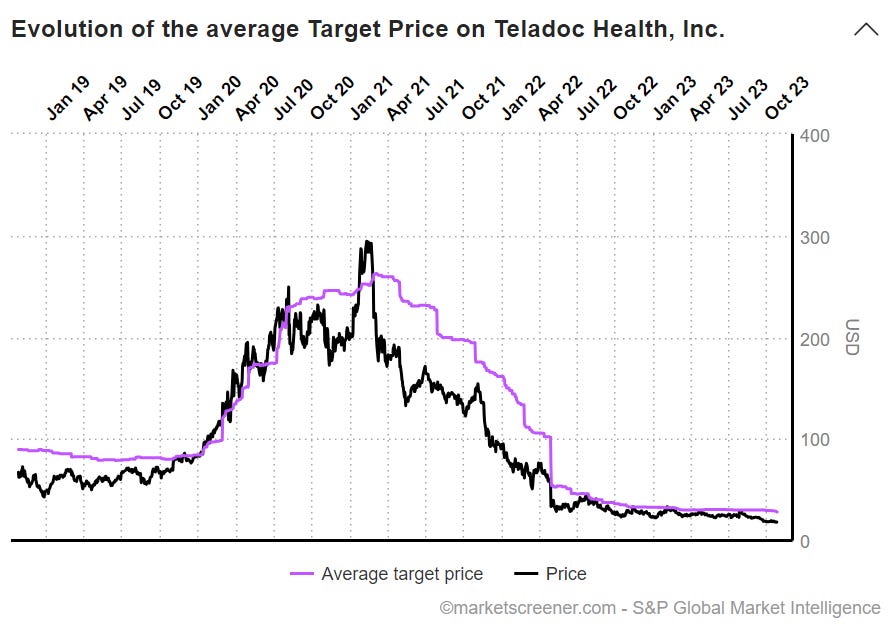

This also translated into analysts’ price targets:

What is also important to note here is the high correlation between the target provided by the analysts and the price.

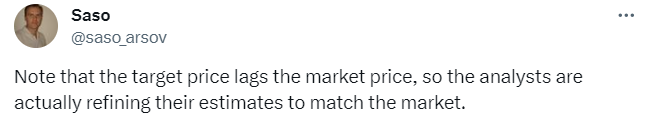

Below is a tweet from someone I respect a lot - Saso Arsov - my University professor of Financial Management. His short tweet summarizes this best.

This is why it is important to process all information with caution. Even the top management can be significantly wrong in their estimates.