It is easy to look like a genius in bull markets. Positive sentiment drives stock prices up, hiding underlying weaknesses. The fear of missing out adds more fuel to the fire.

However, this doesn’t last forever. When market conditions change, risky investments and poor strategies are exposed, and those following the crowd without doing their homework, eventually learn a harsh lesson.

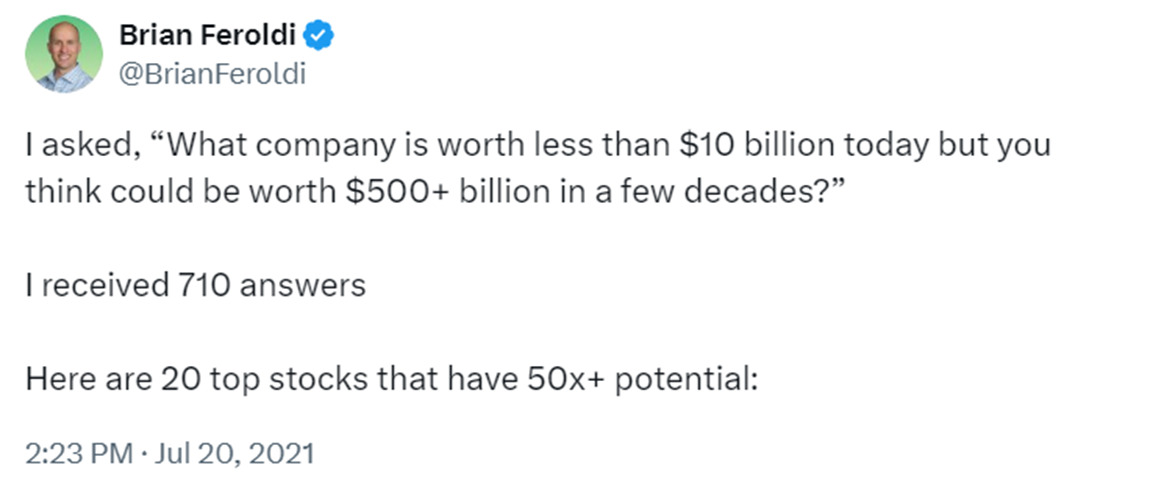

Back in July 2021, Brian Feroldi, who has more than 500k followers on X (formerly Twitter), posted the following thread.

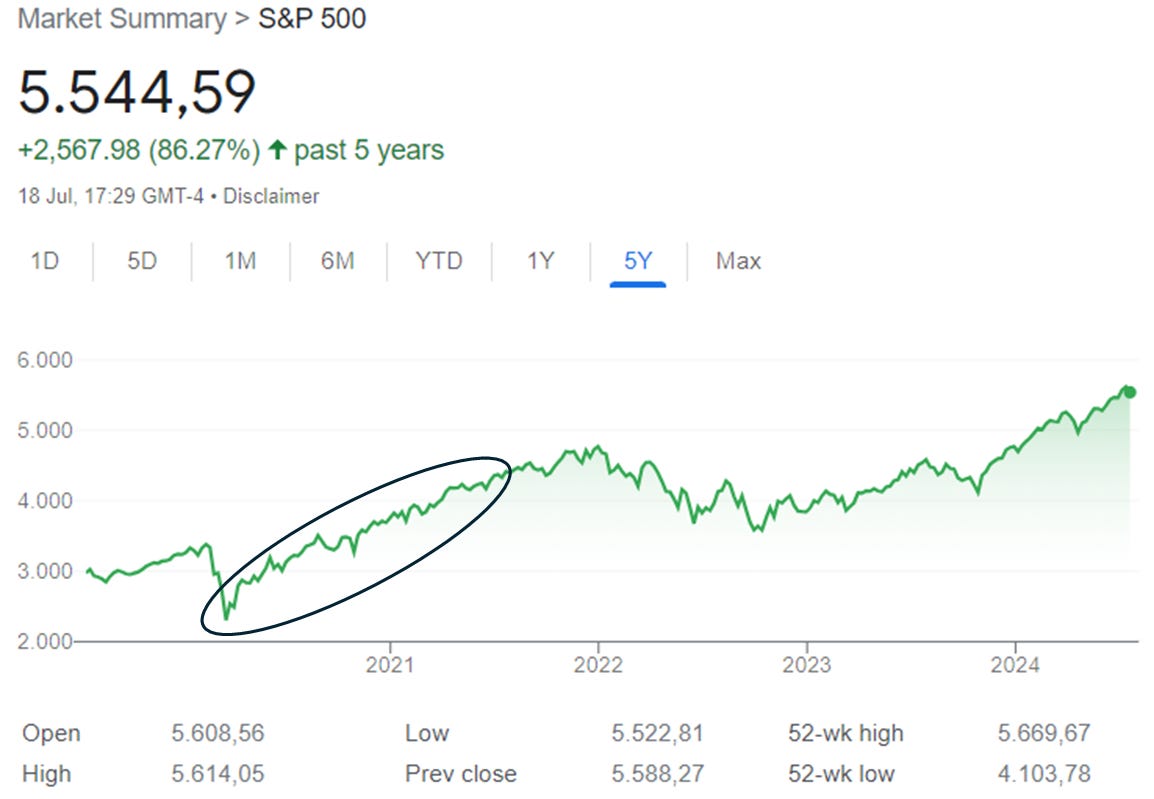

The sentiment at the time was very positive, with the S&P 500 increasing over 90% in roughly a year since the pandemic low in March 2020.

The fuel (in the form of stimulus checks) was there. At the time, I bookmarked the thread, thinking it would be a good idea to revisit it in a few years.

Here we are, three years later:

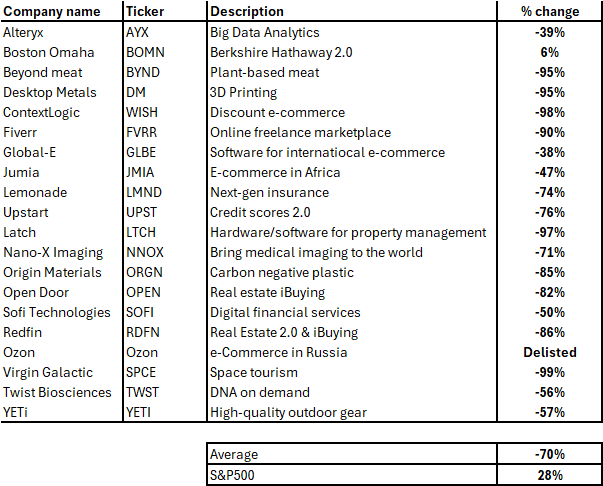

The table shows the performance of the “top 20 stocks that have 50x potential“. The average decline was a staggering 70%, compared to the S&P 500’s gain of 28% over the same period.

All of the 20 stocks underperformed the S&P 500.

The dramatic decline in these stocks serves as a cautionary tale about the dangers of following the crowd in investing. Despite the initial optimism and promising potential, the reality has been a harsh lesson in the importance of thorough research. As Warren Buffett aptly said, "Only when the tide goes out do you learn who has been swimming naked." This experience underscores the need for investors to be diligent and cautious, especially during market highs.